Yesterday

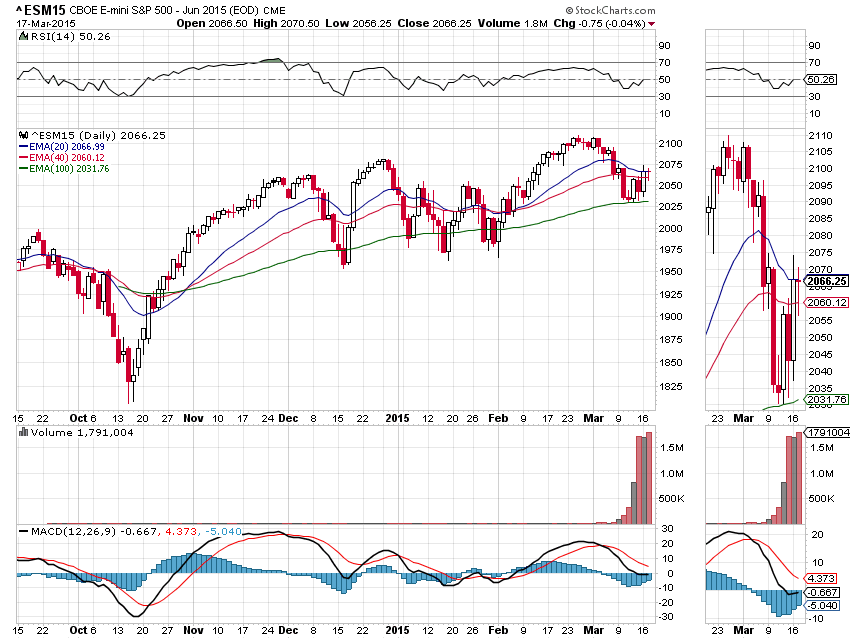

After a nice run on Monday, the S&P 500 mini-futures (ESM5) slipped back into consolidation mode yesterday (Mar. 17). The futures closed at 2066.25, down a couple of points on the day, but the trading was indecisive – the market dropped 18 points off the open, and clawed its way back up in the afternoon to form a doji (opening and closing prices were almost identical) and an inside day (all the price activity was contained within the previous day’s range).

Both of those indicate a consolidation, something like a spring being wound. Today we are likely to see it released in the afternoon when the Fed Open Market Committee minutes are released and Fed Chair holds a press conference. The presser may make news, to the extent that the Chair may slip into standard spoken English at some point, always a risk with unscripted comments.

The algos will be parsing the commas – digitally, of course, and at the speed of light – searching for the word “patience.” If they find it, they will assume it means the massive 0.25% rate increase may not come soon, if at all. If the word is missing, they will assume it means the rate increase may come in June, or sooner. Millions of dollars will change hands based on this silliness.

Today

Today is a critical day. The ES will likely give us a decision about its direction for the rest of the week, and perhaps beyond.

There are two inflection points in play. A move above 2073 is likely to push the price up to fill the gap around 2077, or higher up to the 2085.25-88.75 zone to test last year’s high area.

A break below 2053.75 could trigger downside selling pressure and lead the price lower toward the 2031-33 area, which is the 100-day moving average line.

The ES should give us a better clue after the Fed press conference. Be patient and trade with caution today.

- Major support levels: 2035.50-33.50, 2028-29, 2021-23.50

- Major resistance levels: 2085-88.75, 2094.25-96.50

ESM5 Daily Chart, March 17, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.