The Nasdaq diverged from the broader market on Tuesday in a rather convincing manner. The advance, led by Apple (AAPL), reflected broad participation from the small caps, while large caps languished. This is a sign that animal spirits are alive and well.

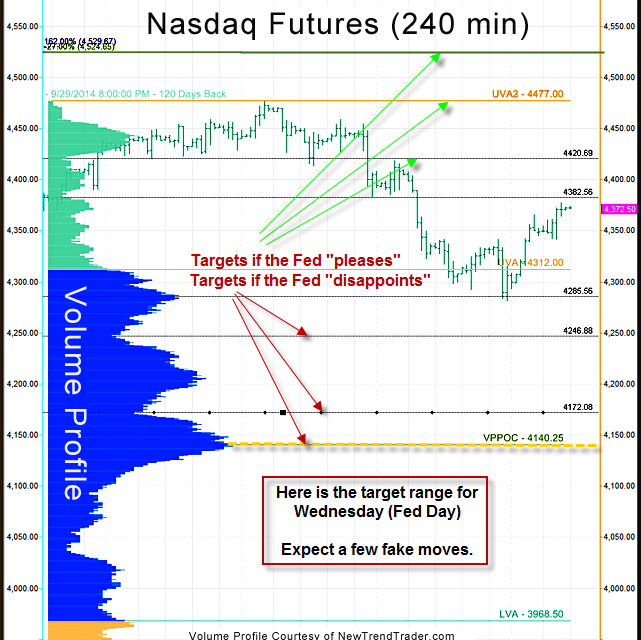

The Fed will dominate headlines on Wednesday and volatility is expected. Taking a literal view of the potential outcome gives “good news” targets at 4420, 4477, and 4525. “Bad news” targets are at 4246, 4172, and 4140.

In my experience, however, trading futures with a literal mindset is ill-advised. For one thing, on Fed Day, the market usually puts in a few fake moves before the real one. Additionally, Wall Street logic is often paradoxical, so don’t assume that at the end of the day, “bad news” will necessarily trigger a lower close or that “good news” won’t be sold. Trade what you see, not what you think.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the S&P futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs.

#####

If you would like to receive a primer on using Volume Profile, please click here.