Today is the FOMC announcement. There has been so much hand wringing about the Fed signaling its intentions through the inclusion or omission of one single word, “patient”, that I hesitated to even post anything on the topic. But… here goes.

First, the press acts as if the fate of global financial markets rests with the Fed. So I’ll just point out, as others have previously, that the Fed’s forecasting record as indicated by the quarterly SEP (Summary of Economic Projections) isn’t all that good. For example, let’s specifically look at the projection for 2014 GDP. In December 2013, the central tendency was 2.8 to 3.2%. In March it was pared to 2.8 to 3.0, then chopped in June 2.1 to 2.3. In Sept, 2.0 to 2.2 and in December 2.3 to 2.4. Actual GDP for 2014 was 2.4. In terms of Core PCE Inflation for 2014, the estimates were consistent over time, at 1.4 to 1.6. But Core PCE prices ended the year at 1.2 and are now just 1.1%.

The other key quarterly Fed release is forward guidance as indicated by “the dots” where the 17 members of the Fed project their year-end preferences for the Fed Funds target over the next three years. At the last (Dec) meeting, the 17 darts, oops, I mean dots, averaged an end of year rate for 2015 of 1.125%, and 2016 at 2.537%. The market is wildly different, with EDZ5 (December 2015 Eurodollar contract) at a price of 99.205 or 0.795%, a yield consistent with Fed Funds of 0.50 to 0.625%, a difference of about 50 bps, and EDZ6 at 98.335 or 1.665, consistent with a FF target of 1.25 to 1.50, a difference of over 100 bps. So, one takeaway is that the market is already ignoring the Fed in certain respects, and has been for quite some time.

Second, there are some analysts who say the Fed can’t tighten because inflation is too low, growth is too weak, and the dollar will explode higher. I am in the low growth and low inflation camp, but I don’t see any reason why the Fed can’t move up funding rates by say, 50 bps in the latter part of this year and stop. Sure, it will negatively impact some financial intermediaries as funding rates increase a bit, but banks are already getting paid by the Fed for their excess reserves, and that’s the rate which will rise. A rate hike won’t kill the banks. In terms of the dollar, well, “that train has sailed” as Austin Powers would say. The dollar index was at 80 last June and traded above 100 this month. The idea of modest US tightening has largely been priced in. (However, Emerging Market currencies have been crushed and could see further problems; perhaps a tightening will be the proverbial last straw.). Where there might be an adjustment is in equities. If the price of a stock is the present value of future earnings, and the discount rate goes up, then the stock price goes down. As the discount rate approaches zero, the present value zooms higher. I think that’s part of what has occurred already, and it’s something the Fed wants to reverse in small measure. Not that the Fed wants a lower equity market, but more market discipline generally. In addition, given low global long end yields and tepid growth at best in the US, it’s hard to imagine the US ten-year rate jumping. (I know some people are thinking the US is in a bond “bubble,” but modest tightening almost certainly will not lead to substantially higher rates at the long end.).

In any case, I think the Fed is going to remove “patient” from the statement. The Fed wants to get away from zero rates. I think that even if “patient” is removed, Yellen can and will emphasize data dependency at the press conference. (And the data has been surprisingly weak). Additionally, the last Fed statement noted “international developments” as a possible headwind. That risk too, can be more heavily emphasized. If those two things occur then I think it’s rather unlikely that the market runs amok, as the pace and magnitude of hikes will be perceived as modest. It’s my feeling that the market simply will not and cannot price in an aggressive string of rate hikes, as has occurred in previous tightening episodes.

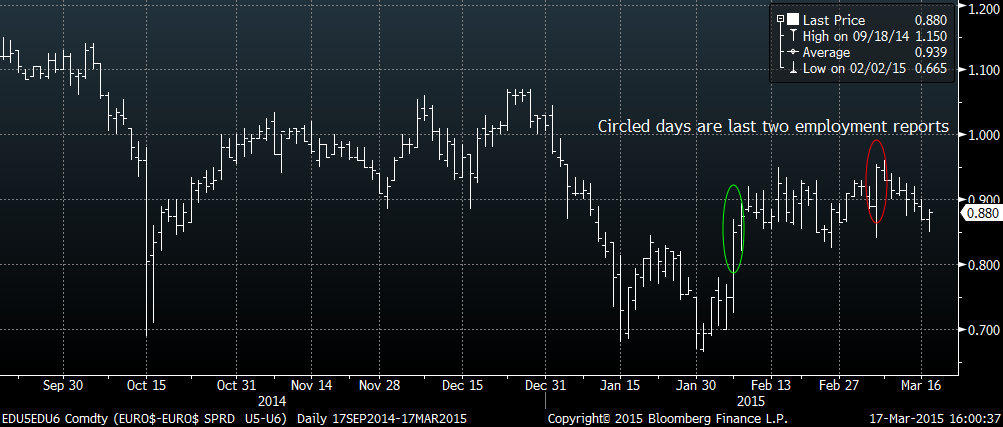

For a market based indicator, consider the peak one-year calendar spread on the Eurodollar curve, EDU15 to EDU16. It has been the peak spread because it’s the timeframe in which the market has perceived the bulk of Fed tightening. Looks pretty tame at just 88 bps. Watch the year spreads for clues about what the market (not the Fed) projects for future tightening.

To learn more about Alex Manzara, please click here.