Yesterday

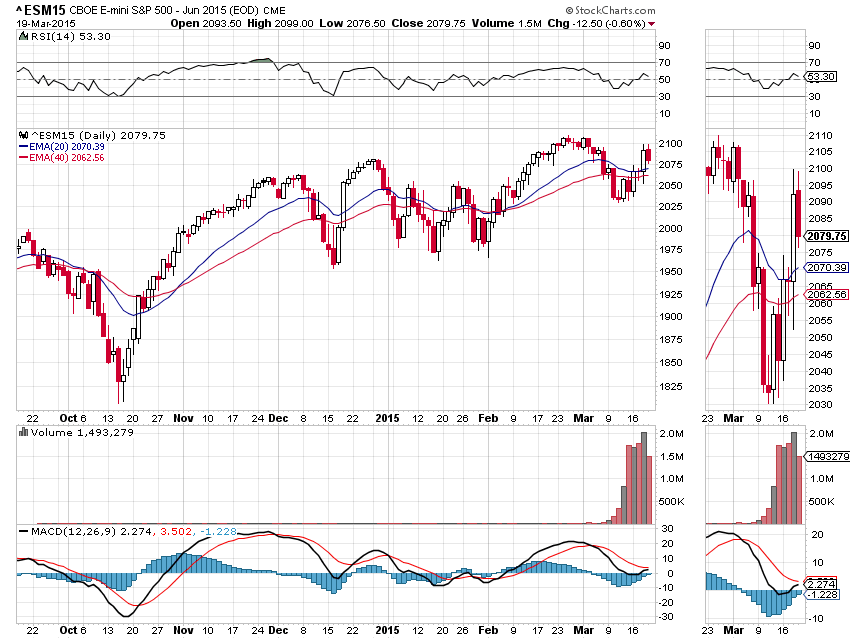

The S&P 500 mini futures (ESM5) had a small pullback yesterday (Mar. 19) while the market digested Wednesday’s monster 45-point rally. The June contract closed at 2081.50, about 10 points below the previous close.

The futures drooped in overnight trading, but the Bulls tried to move it up after the open and got as far as 2089.50 in the first hour. But the move failed to reach the previous close, and dropped back sharply to the low of the day, 2076.50. The market recovered a little in the afternoon session, but settled into a desultory four-point range that even the algos couldn’t be bothered with. Ho-hum.

Today

Today (Friday) is the index-futures-contract expiration and option expiration for a variety of instruments – the March index futures contract expires at the open, and stock options, stock future options, and index options expire at the close.

The option expirations may mute the price action, but there is always a possibility the in-fighting for favourable end-of-day positions may generate some large price swings.

Today the 2070-62.50 zone needs to hold ES up until the end. A close above 2080 is needed to maintain the current upside direction.

Yesterday’s low (2076.50) is the control key for the downside. A break below it could send ES down toward 2072-68 or lower to 2062.50-57.50 zone, which was the start point of yesterday’s news move.

If ES does pull back into the 2057.50 line – the point where the fireworks started – it will give the impression that Wednesday’s rally was just a fleeting, emotion-driven blip, and the market will be thinking down, not up. But if the 2072-68 zone holds up today, there still is a chance for ES to move back up to 2100-04 and perhaps higher.

- Major support levels: 2062-58, 2035.50-33.50, 2028-29

- Major resistance levels: 2085-88.75, 2094.25-96.50

ESH5 Daily Chart, Mar. 19, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.