Last Week

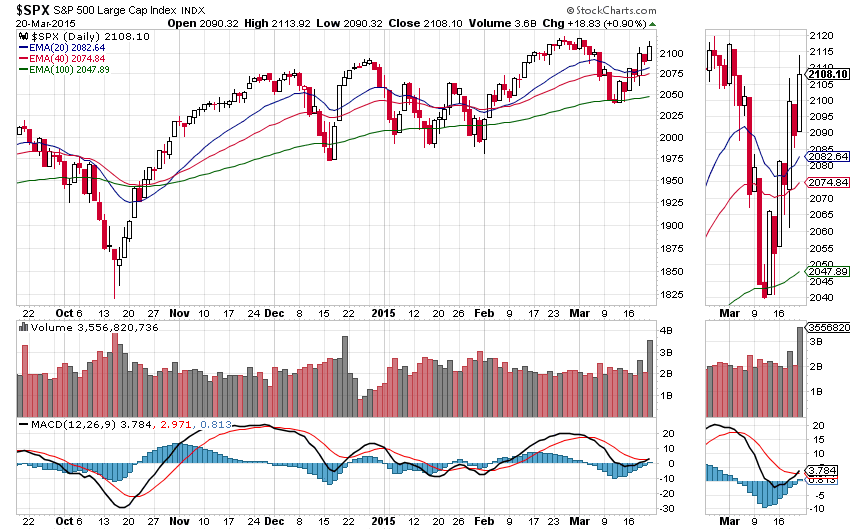

The S&P 500 cash index ($SPX) closed at 2108.10 on Friday, up 55 points for a weekly net gain of 2.68% and within sight of the all-time high made in February. The NASDAQ had a similar rally. It closed above 5000 for the first time in 15 years, just one or two hard pushes below the high made in the year 2000. Heady stuff.

The proximate cause of all this heavy breathing was a relatively modest statement from the Fed Open Market Committee (FOMC) on Wednesday removing the word “patient” from its statement. But that was followed by a remarkably dovish press conference by the Fed Chair Wednesday and an even more dovish statement Friday from Charles Evans, president of the Chicago Fed, saying the Fed should “be in no hurry to raise interest rates.”

In a market that now moves only in response to the real or imagined intentions of the central bank, that was enough to send the large-cap index flying into the end of the week. The SPX has now gained almost 75 points in the last seven trading days.

Friday was the end of the Quad Witching Week, and, as usual, there was a little market manipulation into the close. APPL was pushed down $3 on absolutely no news in the last few seconds of trading. That slam temporarily removed about $10 billion from APPL’s market cap in a matter of seconds.

Of more importance to somebody, it also meant that almost 45,000 Calls at the $127 and $126 strikes all expired worthless. Slick move.

This Week

Quad witching may be behind us, but there is lots of room for “interesting” market activity this week. There is a full roster of economic reports, especially the GDP report on Friday, as well as Fed members making speeches virtually every day of the week – and they are not all rowing in the same direction. It could get confusing.

We think Friday’s closing price indicates that the SPX has completed its short-term correction, and that the low made at 2039.69 could be the bottom for March. If the SPX holds above the 2045 line, our predicted upside targets will still be in play. (See this link)

If the SPX stays above the 2085-75 zone, the short-term uptrend remains intact, and buyers will focus on the upside targets for this week: 2125-30, 2138-39, 2149-52 and 2161.25-76.25.

The market could be moved around by external events in the form of economic reports, statements by Fed governors or unwelcome news from Europe or the Middle East. However, we think any disruptions of that nature are likely to have only a brief impact on price moves.

Mini-futures

The SP500 mini-futures (ESM5) made a high Friday at 2106.75, but couldn’t close above the 2100 level, so we may see a repeat of Friday’s range today (Mar. 23).

The low made in the regular trading hours (2092.25) will be the first support line. A move below it could lead ES down to 2085-81 or lower to 2078-75 to test Friday’s Globex low, which will be the major support line for the short term.

A break above 2106.75 could push the ES up near the resistance zone around 2118 – 2125. That could be today’s high area if ES does break through 2106.75 during overnight trading.

As long as ES doesn’t go below 2070, we will continue to see “Buy the dip” moves.

- Major support levels: 2085-81.50, 2075.75-72.50, 2065.50-62.50

- Major resistance levels: 2110.50-12, 2121.25-23.50, 2135-38.50

SPX Daily Chart, March 20, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.