Record-keeping and tax-reporting requirements can be a nightmare for active traders and their tax preparers. Unless your trades lasted more than a year, you are being taxed at short-term rates, known in tax parlance as “ordinary” income tax, and there’s often nothing ordinary about having to pay the bill.

Avoid the Same Problems Next April

If you trade in your IRA instead of your taxable account, you’ll be relieved of both the tax-reporting and tax-paying problems. If you are a real mess when it comes to keeping track of your stock trading, an IRA is perfect for you. Gains or losses in an IRA are not reportable, so you don’t need any official records of stock buys and sells in your IRA. You should want to keep track of them anyway for your own portfolio management, but the IRS does not care what happens in your IRA as far as stock sales go, because these transactions have no current tax effect.

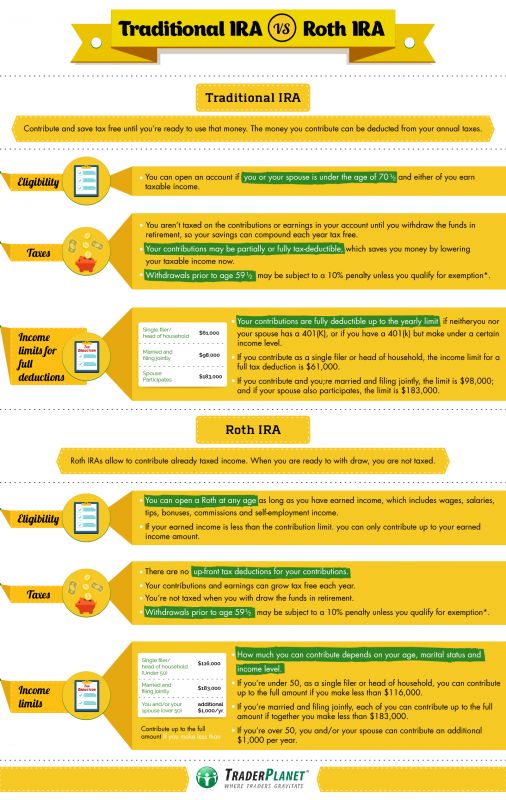

But which is better for taxation purposes, a Traditional or Roth IRA?

The main difference is when you pay taxes on the money you put in the plans. With a Traditional IRA, you pay the taxes on the back end – that is, when you withdraw the money in retirement. With a Roth IRA, it’s the exact opposite. You pay the taxes on the front end, but there are no taxes on the back end. In 2015, the contribution limits for both Traditional IRAs and Roth IRAs is $5,500. Anyone reaching the age of 50 before the end of the calendar year is entitled to an additional catch-up contribution of $1,000. That brings the total contribution limit to $6,500 for anyone age 50 or older by the end of 2015.

Roth Trading Profits Grow Tax Free

For traders, who should expect to grow their account significantly, a Roth IRA may be the better tax deal since your gains will never be taxed as long as you hold it for 5 years and until you reach 59-1/2 years old.

Also, you never have to withdraw from your Roth IRA at 70-1/2, as you are required to do in your Traditional IRA. If you never withdraw your trading gains in your Roth IRA while you are living, your beneficiaries will also be able to withdraw from your Roth and never pay income tax on those withdrawals.

Even if you are a long-term investor, and would only pay at a top capital gains rate of 20 percent, the Roth IRA is still a better deal. If you need to withdraw funds from the Roth IRA, withdrawals of contributions will always be tax and penalty free.

#####

For more a free whitepaper – Five Reasons Why You Should Be Trading In Your IRA, click here.