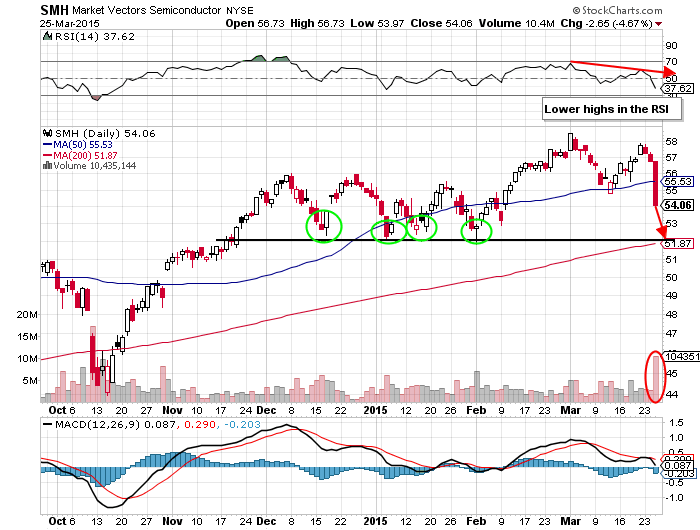

Leading the sell-off of the major U.S. equity indices on March 25th was the NASDAQ, and, more specifically, it was the semiconductor stocks. The Market Vectors Semiconductor ETF dropped nearly 5% on more than three times the average daily volume. For the week, the semiconductor ETF is off by more than 6%, which may lead you to believe that this is overblown and has probably run its course. However, when you look at technical analysis (the charts) and bearish options order flow, the pullback is likely to extend into a full blown correction.

The 4.67% drop pushed the ETF below the 100-day simple moving average for the first time since October. This type of breakdown on more than 10-million shares traded sets up for continuation down to the $52 support level that held on four occasions from December through February (where the 200-day simple moving average is). The secondary indicators on the 6-month daily chart, RSI, and ADX (w/+DI and –DI), are confirming the strong possibility of at least $2 of additional downside risk.

Unusual Options Activity

The Market Vectors Semiconductor ETF, which consists of large tech companies such as Intel, Texas Instruments, Broadcom, and Micron Technology had a trader on Wednesday close out his 50,000 Apr $55 puts for $1.55 (paid $1.35 on February 24th) and bought 50,000 May $53 puts for $1.40 at the same time.

Other notable bearish put purchases include 5,000 Analog Devices June $60 puts for $2.80-$2.90 (typically trades 257 puts per day), 4,000 NVIDIA Apr 17 $22 puts for $0.54-$0.78 (downgraded to sell at Goldman Sachs on March 23rd), and 12,000 Corning May 15 $23 puts for $0.75-$0.78 (5x the average daily volume).

Any way you look at it, many technology stocks should be avoided over the next couple of months, as large hedge funds and institutions put on bearish positions and/or purchase protection out of fear of weak Q1 earnings or sector rotation.

#####

To read about Mitchell’s Unusual Options Activity Report featuring that put buying in NVIDIA and more, please click here.