Yesterday

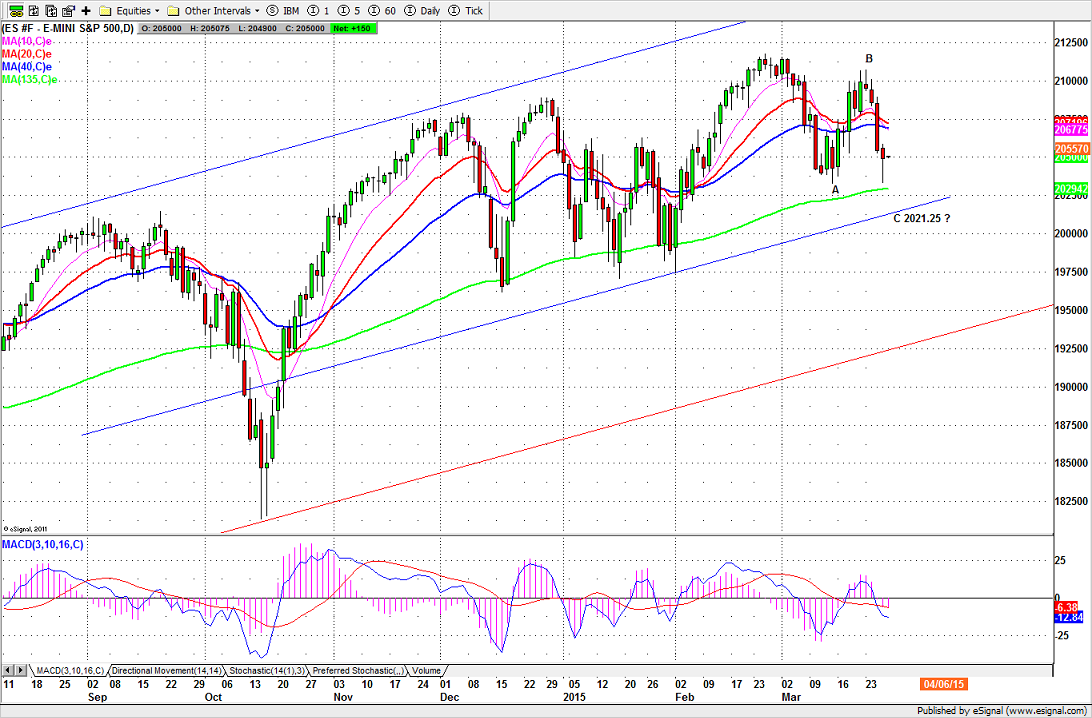

The SP500 mini futures (ESM5) sold off sharply in overnight trading before yesterday’s open (Mar. 26), but the 135-day moving average line, which has supported the futures for about four months now, held again, and provided a little bounce after the regular session opened.

During regular trading hours, the ES made a strong push up and traded in positive territory for a while. But, by the end of the day, it dropped back below the previous close. The futures closed at 2048.50, about five points below Wednesday’s close. The volume was larger than we have seen in the past few days.

If this was supposed to be a recovery from the slide in the first three days of the week, it was not very impressive. The end of the quarter looms, and so far in 2015 the market’s net return is… zero.

Today

Today, the GDP report will be released in the early morning before the market opens, and that will provide the impetus for some movement around the open.

The ES could run up to yesterday’s high 2058.75 -64.25 first, if the GDP report is good and if overnight trading stays above the 2046.50 level. But it could also drop back down to yesterday’s low in the 2033.25-29.50 area first, if overnight trading fails to hold up 2046.50.

The short-term trend is down, and ES needs to fight back above 2075 and close above it in order to keep the trend neutral.

The 135-day moving average, currently at 2029.50, remains an important support level for today. A move below it will be bearish, and a further decline toward 2021.25, or lower, should then be expected. If this occurs, the intermediate-term correction should start soon, especially if ES closes the week below 2018.50.

- Major support levels: 2035.50-33.50, 2028-29, 2015.50-14.50, 2004.75-06

- Major resistance levels: 2066.50-64.25, 2078-79.50, 2088.75-89.50, 2107-08

ESM5 Daily Chart, Mar. 26, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.