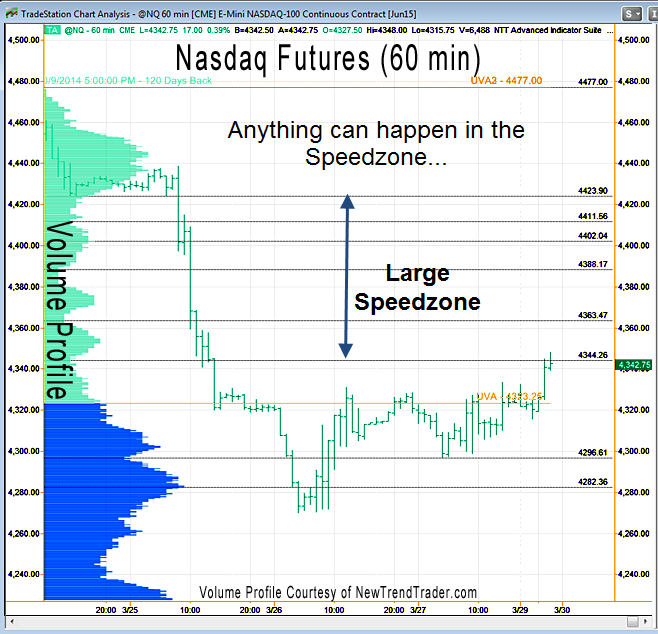

The precipitous decline in the NQ on Wednesday (3/25) created a speed zone that the market is now entering from below. The principle of the speed zone is simple – a market that falls quickly can rise just as quickly. This is especially true in futures markets where mean reversion is the primary trader orientation.

Because the 4210 area (not shown), which is the Volume Profile Point of Control (VPPOC) for this 120 day profile, also coincides with an unfilled gap in the NQ that’s my downside target.

That said, as noted on Friday, a bounce of unknown proportions is to be expected here. People get inappropriately bearish after sudden declines and then get squeezed when immediate follow-through doesn’t happen. So, be sure to trade what you see, not what you think should be happening.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the S&P futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs.

#####

If you would like to receive a primer on using Volume Profile, please click here.