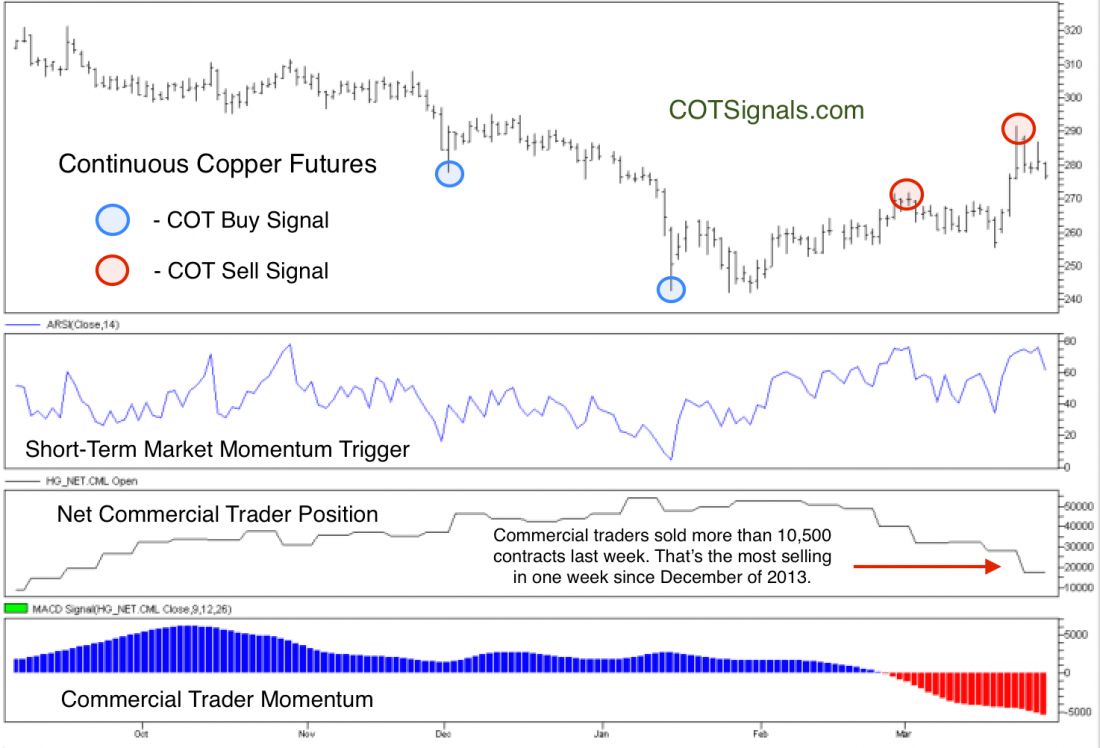

We’ve been watching the copper market closely over the last few months because the commercial copper traders had built up a record long position heading into January. The general consensus was clear that commercial long hedgers were taking advantage of depressed prices to load up raw materials in the expectation of a big construction season.

However, even before the Federal Reserve Board’s recent expression about growth concerns, it was clear that the commercial traders had noted the error of their ways. It is the commercial trader long hedgers bailing out of their record position that has been the story of the copper market this spring, and Friday’s action finally provided us with our proprietary Commitment of Traders, “sell signal.” The logic behind the signals is very simple.

First, we only trade in the same direction as commercial trader momentum. They sold more than 10,500 contracts last week. That’s the most single-week selling in over a year, and it has firmly driven their momentum in the bottom pane of the chart below into negative territory.

Secondly, we wait for short-term market momentum to move against the commercial traders who are less susceptible to general market noise. We use the market noise to setup tension between these two groups. Finally, Friday’s decline brought the market back below our overbought threshold thus, completing the COT sell signal.

Applying this setup in today’s copper market provides us with a couple of trading opportunities. The standard application would call for executing a short position and placing a protective buy stop at last week’s high of $2.9145 per/lb. in the May contract; however, given the recent consolidation …

The Trade

- A breakout trade to the downside could also be effective.

- Place an entry sell stop at $2.7650.

- If this order is filled, place a protective buy stop at whatever today’s high is when the sell stop is filled, currently $2.7905.

- Our short-term target is the $2.70 area.

#####

For more from Andy Waldcock, please click here.