Last Tuesday, our headline was “SPX- Hangover Stage Approaching” It really wasn’t a tough call to make, and the SPX ended up giving all of the gains it made the week before. We are in a very volatile stage and traders are going “All-In or All Out” at the exact wrong times. The key to making money in this environment is to take advantage of the mistakes traders are making.

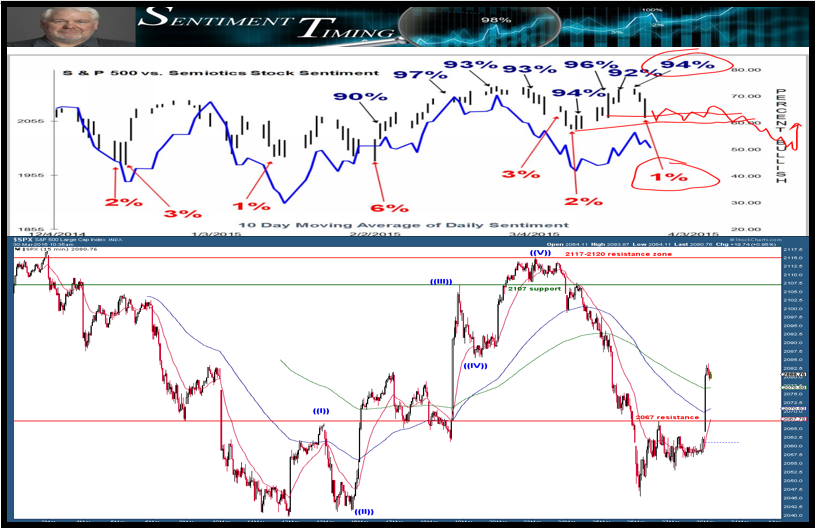

You have to anticipate these reversals and position your trades accordingly, before the rest even know what is coming. Investor sentiment, which Woody Dorsey puts together in the “Sentiment Timing” report, is the best way to see how traders are feeling about the current market environment.

When the majority is bullish, simply start looking at resistance levels to build a short position; when the majority is bearish, look for support to build a bullish position.

On March 20th (Friday), we had a series of bullish-extreme readings from the sentiment charts. We were able to see 5 waves up, and the SPX was running into resistance. Anticipating a reversal to the downside was the correct thinking and the SPX dropped some 70 points in five days. As soon as the majority turned bearish, a low was made, and the SPX has now rallied some 36 points in 2 days.

Forget about the bigger picture! Just trade these big swings over and over again, and you will make more money than any trend trader, because for the 4 months, there has been no trend.

The SPX is trading within 10 points of where it was in December. That is not a trend. Look to short when the majority is bullish and long when the majority is bearish. It really is that simple.

#####

To get your Free Sentiment Timing Index Chart. please click here.