To reiterate the high points of yesterday’s forecast, the fast decline in the NQ on Wednesday (3/25) created a speed zone that has very little resistance to rebound action. The reason is that sellers were liquidated in that zone. With few sellers lurking to get out at breakeven, it doesn’t take much volume to levitate the market, and the NQ rose more than 1%.

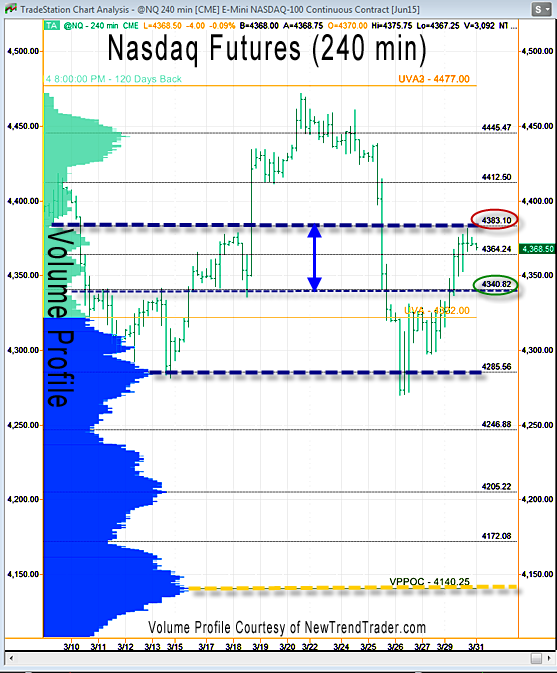

This took the NQ about half way up the water spout, pausing at 4383, which is an important Low Volume Node. Remember, low volume levels have stopping power. This is a key resistance level for Tuesday, with key support at 4340 defining an expected range.

If the bears have more to say, then 4205 and 4140 are deeper targets. It might take the market a few days to figure out where it’s going. A break below 4340 would be bearish.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the S&P futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs.

#####

If you would like to receive a primer on using Volume Profile, please click here.