With a few exceptions – GoDaddy (GDDY), a recent example – 2015 has been fairly light on headline-grabbing IPOs. That figures to change this week, however, as there are a few highly-recognizable companies looking to go public.

Of that set, the one that may garner the most attention is a high-growth online retailer catering mostly to women. That company, Etsy (ETSY), is offering 16.7 million shares with the deal expected to price within a $14-$16 range.

The IPO features prominent underwriters, with Goldman Sachs acting as lead manager and Morgan Stanley and Allen & Company as the co-managers.

Closer Look at ETSY

ETSY, established in June 2005, operates an online marketplace where people can connect to make, sell, and buy unique goods – in particular, handmade goods.

ETSY has a very large user base, consisting of 54.0 million members, including 1.4 million active sellers and 19.8 million active buyers. As of December 31, 2014, the company generated gross merchandise sales (GMS) of $1.93 billion, up 43% over 2013.

Its business model is based on “shared success,” meaning that it makes money when sellers make money. About 86% of its sellers are women and about 95% of sellers run their Etsy shops from home.

Revenue is diversified among a mix of marketplace activities and services. Marketplace revenue includes the fee an Etsy seller pays for each completed transaction, and the listing fee an Etsy seller pays for each item she lists.

Seller Services revenue includes fees an Etsy seller pays for services such as prominent placement in search results via Promoted Listings, payment processing via Direct Checkout, and purchases of shipping labels.

Growth Drivers

A major part of ETSY’s growth plans include building more local marketplaces, but on a global basis in new international markets. It is investing in, and will continue to invest in, local marketing and content and local payment and shipping services in countries around the world.

ETSY intends to enhance its seller services and extending their geographic reach by introducing new features.

Finally, the company has been investing heavily in sales and marketing to increase its reach and build its membership base. It doesn’t plan to take its foot off the accelerator in the near future, saying it pays to increase marketing spending on traditional and online media to increase awareness.

Financials

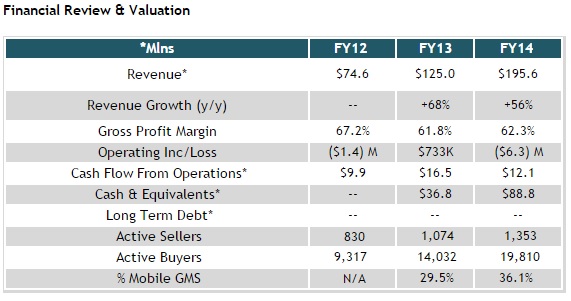

While its financials are not pristine, there are a couple noteworthy bright spots. First, revenue growth has remained very strong, at high double-digit rates. The deceleration in its topline growth rate from FY13 to FY14 was not dramatic, which we take as a positive sign, given that its absolute revenue base is growing larger.

Taking a look at its results for FY14, revenue grew 56% year/year to $195.6 million. The growth was driven by a 43% jump in gross merchandise sold (GMS), to a total of $1.93 billion. Breaking down that GMS figure, international GMS increased as a percentage of total GMS to 30.9% from 28.4% in 2013. Further, mobile GMS as a percentage of the total increased to 36.1% from 29.5%.

Membership rates also climbed as active sellers grew to 1.4 million and active buyers increased 41% to 19.8 million.

Conclusion

In a busy week for the IPO market, featuring a few high-profile deals, ETSY could be the one that garners the most attention. Its fundamentals are somewhat mixed, but, from a growth perspective, ETSY looks like an intriguing option.

There are two main knocks we have. First, ETSY is not profitable on an operating basis. However, it is cash flow positive, so that mitigates our concern there a bit. Second, its valuation is on the high side. Should it open with a decent pop, its valuation would look even more stretched.

Overall, though, ETSY is an IPO we are positive on, and feel that it should perform well next week. It’s not without its blemishes, but, we feel the positives do outweigh the negatives.

#####

For more on Dennis Hobein, please click here.