Yesterday

The S&P 500 mini futures (ESM5) gapped down at the open and traded in the red for the entire morning session. Then a handful of Fed presidents began giving speeches, and the market marched up like a good little soldier in response. But it was all for nothing. The mini rally failed to break the prior day’s high, and by the end of the afternoon, the gains all melted away. The futures closed at 2100.75 – an important number – for a gain of one point.

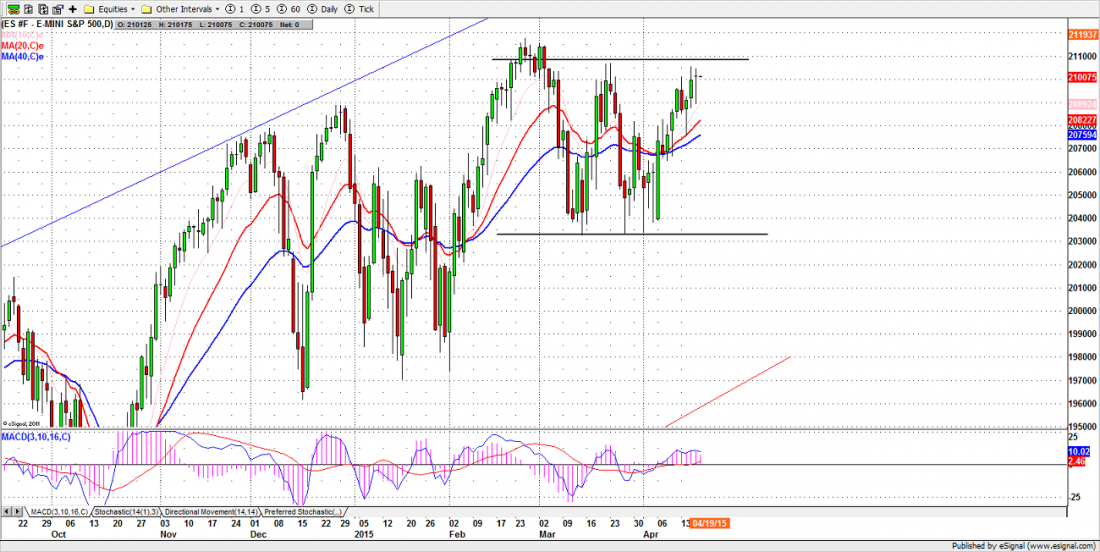

This candlestick pattern – a long body with a small head (see the chart) – is called a doji or a spinning top, and it often indicates a change in direction or at least indecision in the market. The bulls can’t push it up, the bears can’t push it down, and it ends the day pretty much where it began.

In this case, it is occurring near the resistance after a pretty good run up from around the 2031 level, and it may mark a short-term top – or not. There’s a lot of disagreement about the significance of dojis.

The volume yesterday was light, and most of the movement looked like algos taking out stops on both sides. The option expiration yesterday may have been affecting the price action.

Today

The light volume and modest daily range yesterday (Apr. 16) may lead to a narrow-range day today. However, we have April options expiring today, and the price may get pushed around as a result. A breakout move is still possible, if there is some kind of good news event to end the week.

A move above 2106.50 – i.e. past yesterday’s high – could push the futures up to 2110-2112.50, or higher up to the 2117-2121 area. As long as the price stays above 2089, the odds favor the upside. This market is still bullish until it announces otherwise.

- Major support levels: 2071-73, 2062.50-64.50, 2055-56.50

- Major resistance levels: 2107.50-08.50, 2117.25-21.50

ESM5 Daily Chart, Apr. 16, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.