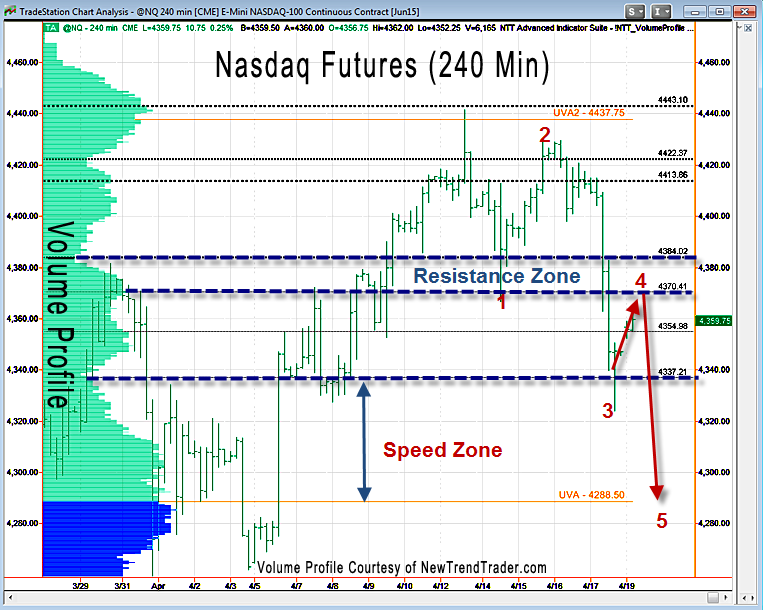

As noted last week, the Nasdaq has been in a choppy and volatile consolidation for the last 6 weeks. These fast moves create SpeedZones that present little support or resistance to retracements. Bulls and bears get punished equally.

The lower support level at 4370 was taken out on Friday, sending the market all the way down to the Low Volume Node at 4337. Remember, areas of low volume often serve as support in a downtrend.

I’m expecting a rally on Monday up to the resistance zone at 4370-4384 and then some extended chop that could last a day or two. Why this specific scenario?

Because the downtrend has plotted a classic wave pattern that that typically resolves with one more down wave, a fifth wave. If that happens, it would occur rather suddenly, but when no one expects it, and take the Nasdaq very quickly to 4288.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs.

#####

If you would like to receive a primer on using Volume Profile, please click here.