July soybean meal fell through major support last week near $315 per ton. There are two points to be made on the market’s action at these levels. Although it may be a bit of a, “chicken and the egg” situation regarding what happened last week, we feel its outcome provides a major clue towards forward direction. Finally, since we only trade forward direction, we’ll focus on the predictive nature of the events surrounding last week’s action in the soybean-meal futures market.

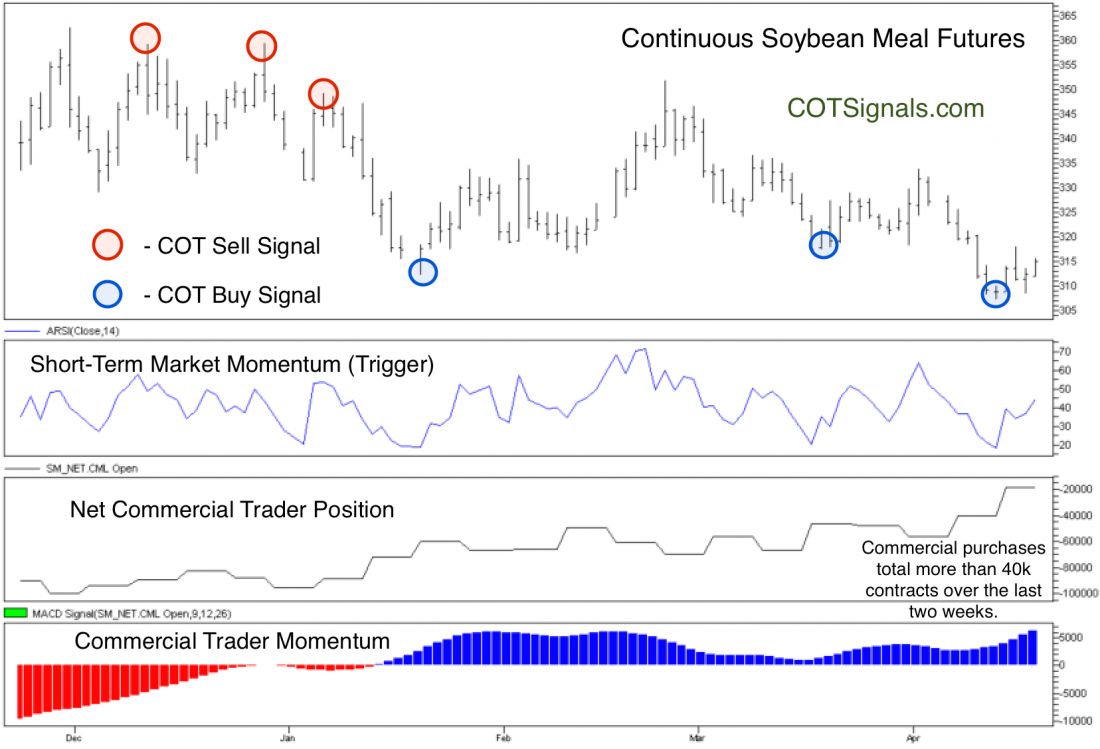

We’ll focus on two areas this morning – internal market action and seasonal analysis. The soybean meal market, particularly in the July futures, had been resting on a shelf of technical support near the $315 area. The market fell through this area on April 9th’s USDA Supply and Demand report. Based purely on technical objectives, this market should’ve traded down to at least test the $300 area. The market actually bottomed at $307.5 on Monday, April 13th. Based on the information we reviewed over the weekend, it appears that the commercial traders are responsible for the buying that supported this market where weakness would’ve been the expected technical outcome.

Commercial traders have purchased more than 40,000 soybean-meal futures contracts over the last two weeks. You’ll notice on the chart below that in spite of these purchases, their net position is still negative. This is why we track both the nominal values of the commercial traders’ actions as well as the momentum of their actions. Based on our research, the more noteworthy the commercial traders’ actions at a given price level, the more important that price level becomes. In this case, it’s a classic case of the commercial traders locking in their forward bean-meal consumption needs at prices they believe are undervalued. You can see the types of entry signals this creates on the chart below.

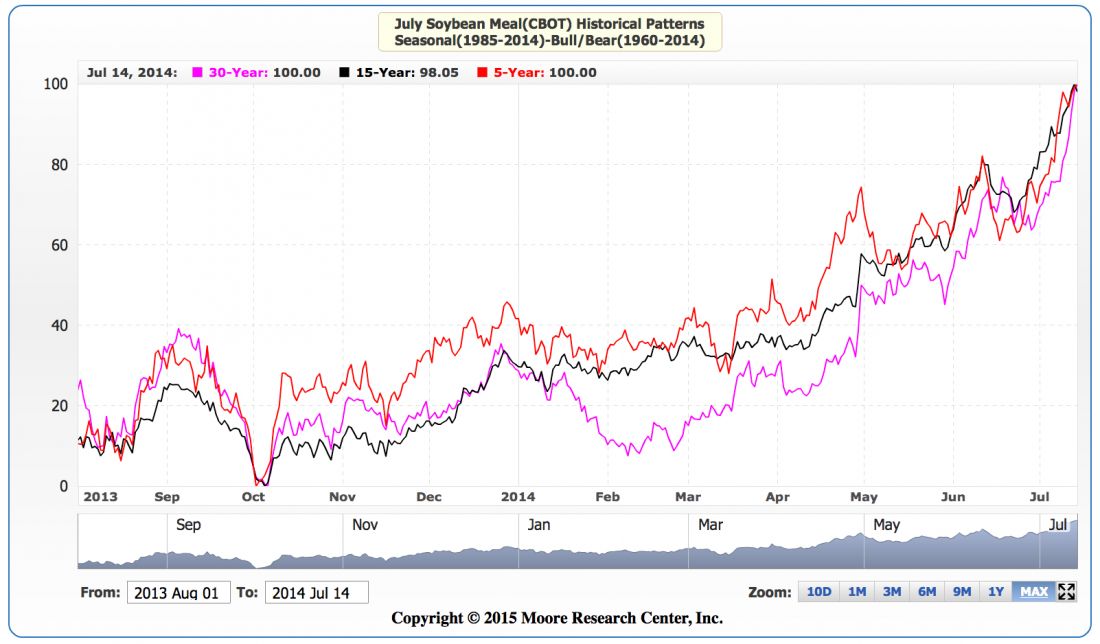

The second point addresses the chicken and egg situation. While our specialty is tracking the Commitment of Traders reports, we follow Moore Research for their seasonal analysis of the commodity markets. Their analysis clearly shows a bullish bias in bean meal beginning near our current point in the calendar and stretching through at least June’s minor plateau. The chicken and egg situation is posed by the questions, “Are the commercial traders buying ahead of expected seasonal strength or, does commercial long hedging at this time of year create the early seasonal bias?” This also falls under the, “correlation does not equal causality” umbrella, as well.

Regardless of the chicken or the egg, the current combination of these two situations should lend a bullish tone to a market that failed to fall when it should have. Our nightly COT Signals used this information to publish a discretionary buy signal for Monday’s trade. A close above $321 in the next day or two would fully nullify the bearish formation that led to the fall through support and possibly signal an important shift in the speculative tone towards the bean meal futures.

#####

For more from Andy Waldcock, please click here.