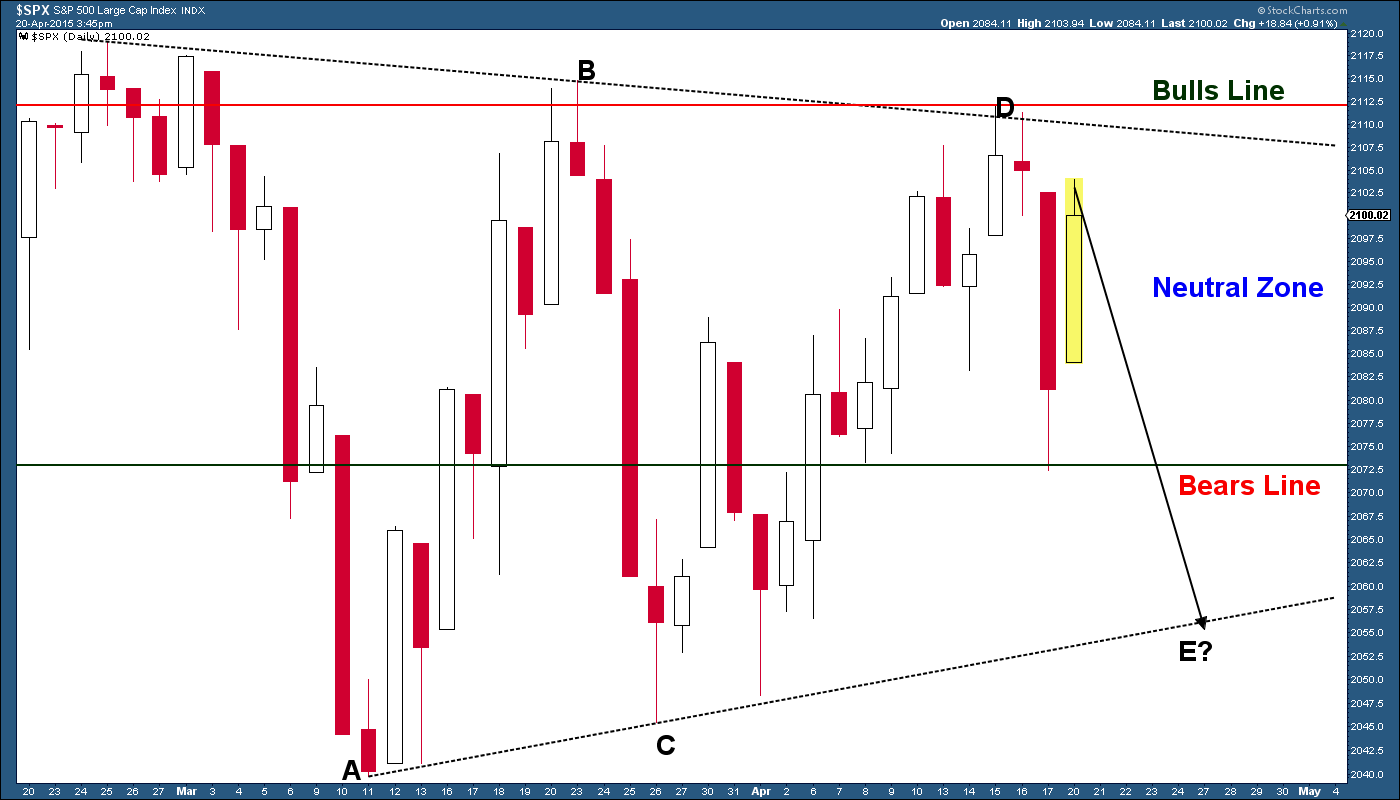

The SPX has been trading within a triangle range for the last 2 months. With every big thrust higher, the bulls are convinced it is breaking out, only to see those gains wiped out in a matter of hours. Then, when we see the big drop, the bears are convinced it is breaking down, only to see those gains wiped out in a matter of days/hours.

These fairly large moves are coming at warp speed and catching both sides leaning the wrong way. Once the long/short squeezes have completed, we are seeing the SPX reverse and head the other way, continuing to trade within the large, triangle-range pattern.

Until this triangle breaks up or down, the SPX will remain in this range. There has been no trading advantage for swing traders since 02/25/15, when this triangle pattern started forming. And until it breaks out, sell the rips and buy the dips. It really is that simple.

If the triangle pattern is going to stay intact, then we should see this rally (04/20/15) give everything back and some to form the wave E of the pattern. As it is forming at the top of the trading range, the breakout should be to the upside, but a test of the 2058 area would have to come first.

As long as the lower triangle support line holds, the next move higher should have the SPX testing the 2160-2180 target zone. Buying today’s rally will only be setting you up for disappointment and risk, selling before the big move hits. Holding onto a long position when you are some 40 points in the red is not easy. And again, if this pattern is going to play out, a test of 2058 is next.

Either wait for the SPX to break above 2116 and jump long. Or wait and see if you can buy closer to the 2060 area, using 2040 as your line-in-the- sand stop. Sentiment hit bearish extremes on Friday, and we are now seeing some bullish extremes today. Trade carefully until the SPX breaks out of this range.

#####

Want to know when the next turn is coming? Please click here.