Yesterday

Last Friday (Apr. 17) the US market sold off – big time. Yesterday (Monday) it bounced back sharply. Both moves – up and down – were attributed to the same event, financial news from China.

Nothing much changed from Friday to Monday. No sudden wars, no big economic news, no new Fedspeak. It is just machines pushing the prices around for fun and profit. The ES remains inside a broad range. So does the SPX. As long as this range contains the price, anything else is just noise.

There is also a noticeable pattern of sharp, fast intraday moves, where most of the day’s price activity takes place within 60 minutes, or in the pre-market trading, followed by a long slow grind into the close. We saw it again Monday.

The S&P 500 mini-futures, the ES, moved up sharply overnight Monday, which led to a gap between Friday’s close and Monday’s open. Then in the opening hour of the regular session, it marched up and stayed up until the last half hour of trading, when it gave back 6.50 points and closed at 2091, a modest 4 points above last Friday’s regular session high.

Today

Today, 2087 will be the key line to watch. Holding above it will encourage the buyers. A move below it could lead the price to drop back down to the 2078.50-80 zone.

But as long as the 2075.50 gap remains unfilled, the ES still could bounce back up to 2095-96 zone or higher up to challenge 2100-05.

- Major support levels for Tuesday: 2071-73, 2062.50-64.50, 2055-56.50

- Major resistance levels: 2107.50-08.50, 2117.25-21.50

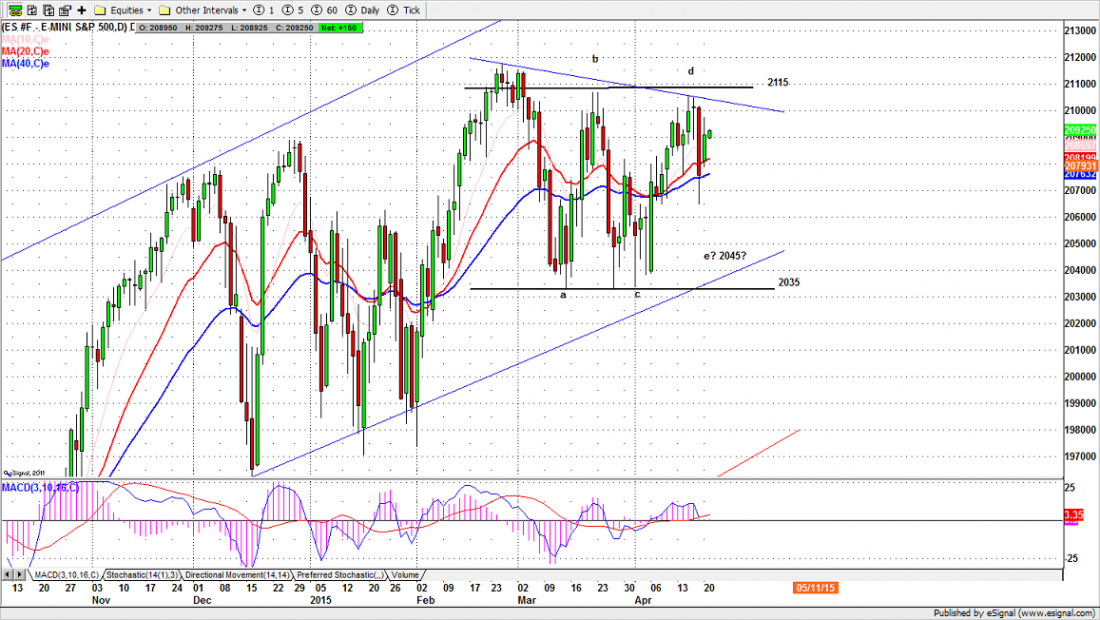

ESM5 Daily Chart – April 20, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.