The market is, admittedly, on shaky footing right now. Economic data is not quite as strong as we would like to see, the FOMC and their rate hike is just around the corner, and 1st quarter earnings growth is not expected to be good.

I could go on and on about how the economic trends are still pointing to growth, or about how the FOMC rate hike has been expected for so long it has no choice but to be factored into current market values, but I won’t. When you boil away all the day-to-day information that drives near-term stock market prices, what you have left with is earnings. Earnings are what drives investors to buy or sell their shares, so that is what I will focus on today.

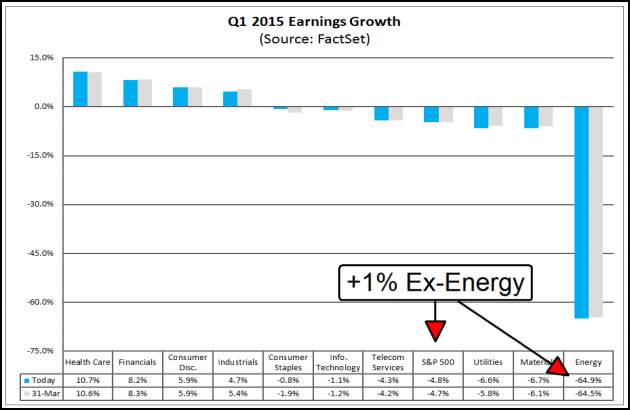

In the near term, earnings growth for the first quarter is not good. If expectations are met, it will be the first quarter of negative earnings growth for at least 3 years. At the start of the quarter, consensus was in the range of -4.6%, it has since fallen to -4.8%, led by the energy sector. It is no surprise the energy sector is going to experience earnings declines, an estimated -45%, due to the low price of oil, as compared to last year. What we need to keep in mind is that low energy prices and all that money the energy companies aren’t earning is a bonus for every other sector of the economy.

Looking at the first quarter earnings projections, minus energy, the picture looks a little different. The 9 S&P sectors, without the inclusion of the energy sector, are projected to grow earnings by about 1%, a lot better than -4.8%. This is led by the financial sector which has so far beaten expectations on the bottom line, if not on the top. Looking back over the past four years, the blended rate of earnings growth among S&P companies has risen by at least 3% from beginning to end of each reporting season. Based on this, and positive performances seen across all sectors to date, it is easy to assume that the total blended rate for the S&P will move up at least to -1% and the ex-energy rate could be as high as 4.5% or better.

The second quarter is expected to be a lot like the first. There is a chance for negative growth, spurring speculation of an “earnings recession”; I’ve been market watching for over ten years, and read a lot of books on trading, and have never heard that word before. Taking into account that this quarter is already better than expected and the 4-year trend in earnings growth expectations, the 2nd quarter projections are most probably way to low. Current expectations are for -2.5% earnings growth, but I suspect it will be positive by the time all is said and done.

Investors Buy Forward Earnings

Since the market tends to focus on forward earnings, rather than the rear-looking view given by earnings reports, let’s take these projections out to the end of the year and next year. On a full year basis, the S&P is still expected to show growth, about +2.5%. This is also probably low due to strength in the 1st quarter and the expected rebound in the 2nd half of the year. The energy sector is expected to show negative growth in the range of -56%. Backing this out of the figures, the full-year, blended rate, minus energy, is looking more like 7% which is OK in my book.

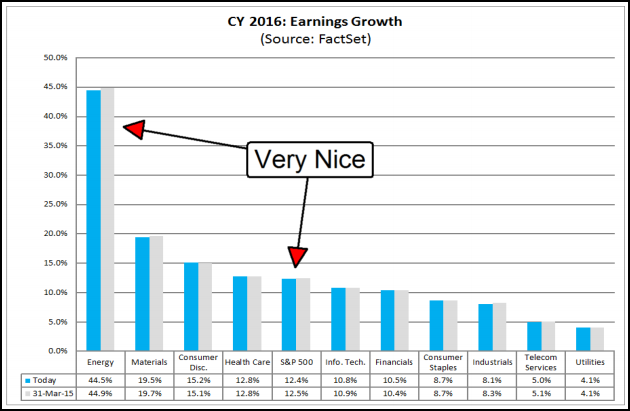

Now, the real clincher, in my opinion, is the outlook for 2016. Full-year earnings growth projections for 2016 are in the range of 12.5%. This is more than 10% ahead of this year’s expectations and, interestingly, earnings forecasts are led by the energy sector. The energy sector is expected to see a rebound in earnings growth next year of +46%.

There may be corrections and there may be one caused by the Fed, but I think it will be nothing more than a great entry for profits. The Fed, the rate hike, the economic data, and, most especially, the international headlines are near-term factors in the market. The long-term fundamental picture is that the US economy is fixed. It’s not robust or even strong necessarily, but it is well on the way to full recovery and gaining momentum. It’s OK to be worried about earnings but don’t discount expectations and trends.

#####

To read more from Michael Hodges, please click here.