Yesterday

In what has started to become a familiar pattern, the real movement in the S&P 500 mini-futures (ESM5) is taking place outside the regular trading hours, and it is being corrected once the terminals start up and the regular-session traders hit their desks.

Yesterday (Wednesday), the minis dumped 18 points overnight, clawed most of it back before the open, dumped a second time in the first couple of hours, but scrambled back a second time. It closed up 9 points from the previous close at 2100 even. That number should feel familiar, because it is just about where it was a week ago.

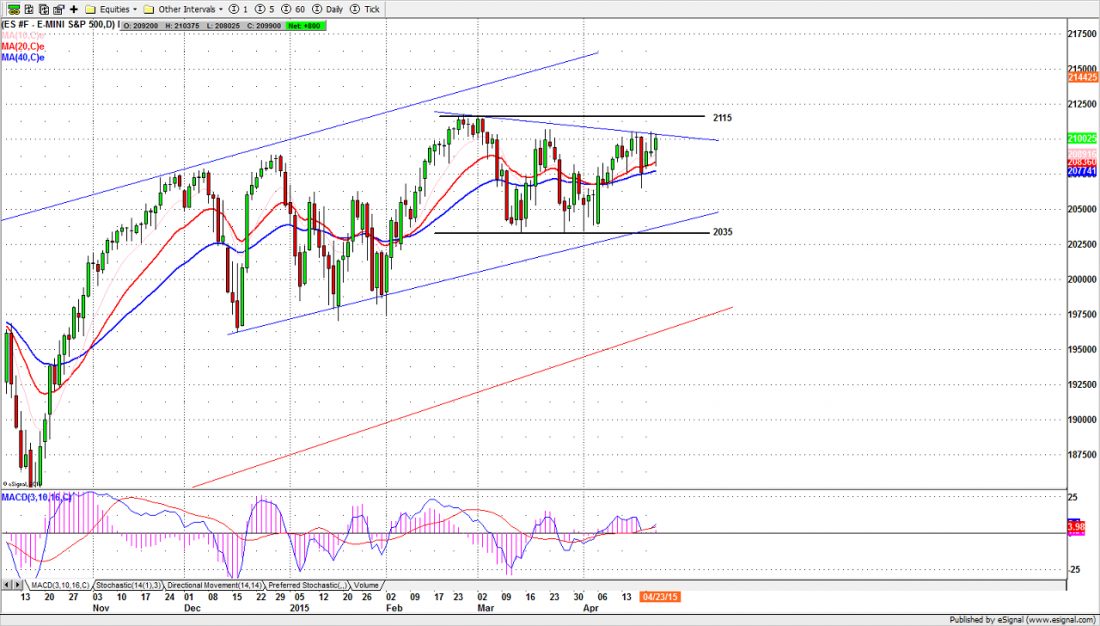

The ES remains inside the broad consolidation range, and it is bumping up against the near-term resistance around 2103-05. However, that congestion area is getting, well, congested. We are still waiting for the break-out.

It needs to come soon. The favorable seasonality is ending soon, and if the buyers lose patience and walk away in May, we may be looking at these same numbers for a long time.

Today

Today (Thursday Apr. 23), we have the Jobless Claims report in the pre-market, and that may goose the futures a bit before the open. The ES needs to break through the 2105.50-2107 resistance zone to start moving higher toward the 2115.50-21.50 target area. A failure to break out could lead to a minor pullback, down near the 2090.50-92 zone.

Our traders will be waiting for confirmation of any upside breakout move before they start following the break-out direction. There are likely to be a couple of head-fakes before the new direction – up or down – is established.

Given the relatively short time left before the seasonality changes – usually the market goes flat sometime in May – we expect an upside breakout, if there is one, it will be the last significant bump for the first half of the year.

Major support levels for Thursday: 2071-73, 2062.50-64.50, 2055-56.50

Major resistance levels: 2107.50-08.50, 2117.25-21.50

ESM5 Daily Chart– Apr. 22, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.