Back on April 10th, General Electric said they were planning on selling most of GE Capital over the next two years (shedding most of GE Capital Real Estate for $26.5B) and announced a $50B share repurchase program to top it off (plan to bring the share count down to 8B from 8.5B by 2018). Shares of GE trade at a P/E ratio of 17.24x (2016 estimates), price to sales ratio of 1.80x, and a price to book ratio of 2.09x.

Due to the asset sales, EPS estimates for 2016 have declined to $1.56 from $1.84, but the rally to six-year highs shows how investors are receiving the exit of the finance unit (more emphasis on the industrial part of the business) and their capital allocation plan. Last week’s Q1 earnings report showed solid growth in most areas of the industrial segment, but the 7% decline in revenue from GE Capital weighed on the results. On April 20th, Barclays raised its price target to $33 from $32 and RBC Capital upped their price target to $30 from $28.

Technical Analysis And Unusual Options Activity

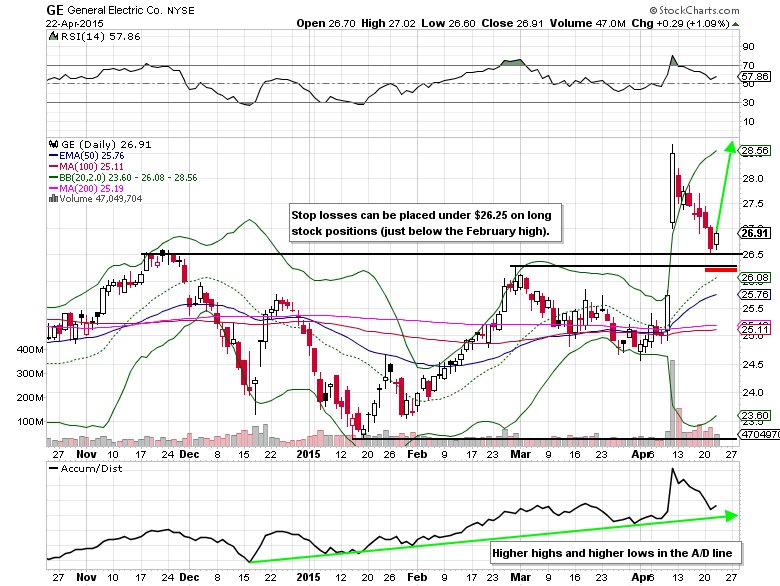

General Electric shares snapped a five-day losing streak on April 22nd, bouncing right off prior resistance at the $26.50 level. For those that missed the latest rally and want to step in, this is your chance (down almost $2 in less than 2 weeks). A completion of the measured move would be at $29.80 (November high and January low difference). Longer-term, the stock could hit the mid $30’s, which is where a large option trader sees upside potential. On February 27th, the Jan 2017 $30/$35 bull call spread was put on 125,000 times for a $0.52 debit.

General Electric Options Trade Idea

- Buy the Jan 2017 $27/$35 bull call spread for a $1.70 debit or better

- (Buy the Jan 2017 $27 call and sell the Jan 2017 $35 call, all in one trade)

- Stop loss- None

- 1st upside target- $3.40

- 2nd upside target- $7.50

Notes: While this trade costs about $0.90 more than the $30/$35 bull call spread, the breakeven is lower at $28.70 vs $30.80. For those wanting a shorter-term trade consider selling a June bull put spread to collect on the higher premiums.

To read Mitchell’s “Unusual Options Activity Report Featuring Put Selling in MasterCard and Visa”, please click here.