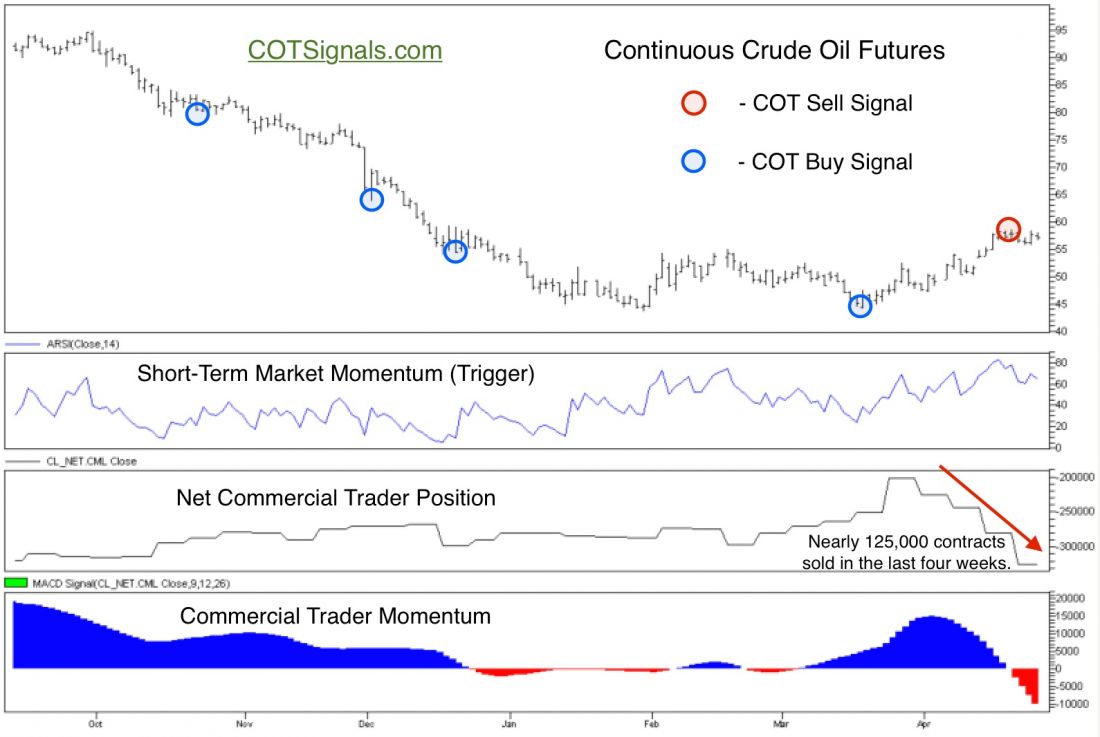

Crude oil’s slide has been well documented along with the causes and consequences. Prices have recovered a bit as we suggested they would, ahead of both the January and March Federal Open Market Committee (FOMC) meetings as detailed in, “Commercial Traders Ahead of the Fed.” The importance of this statement lies in the access the heads of the oil industry have to Washington. The energy industry is simply too big and too well informed to be caught off guard by legislative actions. As the oil market has softened, so has the Fed’s attitude towards the removal of market stimulus. That being said, crude oil producers have used the rally over the last few weeks to unload nearly 125,000 contracts. This is the biggest four week decline since February of 2011.

After months of sideways trading through the holiday season and low gas prices, the massive forward selling of future crude oil production has quickly shifted our commercial trader momentum indicator into negative territory. This puts on the lookout for short selling opportunities and means that we view the recent rally as nearing its end. We also feel that the crude oil market’s rally of more than 30% from last month’s lows has been overdone.

Finally, our simple take on the way these usually work is that we’ll get one more spike of some type above the recent congestion that has built up, in this case just shy of $60 per barrel. Remember that the commercial traders have access to both the physical commodity and the cash to absorb the futures’ movements. Therefore, we will wait for this resistance to be broken on the high side and provide us with a selling opportunity perhaps near $61.50. However, if continued commercial selling should force the market lower without the opportunity to sell the rally, we would be willing to short the market on an entry stop of some sort as it will have forced the market to head in our anticipated direction to put us in the market. Either way, we feel a test of the $53.50 area will be the next important test of support on the downside.

###

For more from Andy Waldcock, please click here.