Yesterday

The S&P500 mini futures June contract (ESM5) traded erratically yesterday (Tuesday) in what was almost the mirror image of Monday’s price action. Overnight it dropped to 2095, which has been an active support level for several weeks, then rallied to open at about the previous day’s close, and moved a little higher after the open.

So far so good. Then it made what was almost a flash crash – down 15 points in 20 minutes on heavy volume – before the Plunge Protection Team woke up and marched it back up for the rest of the day. It closed at 2112, almost the high of the day, and almost exactly where it closed Friday. Sound familiar?

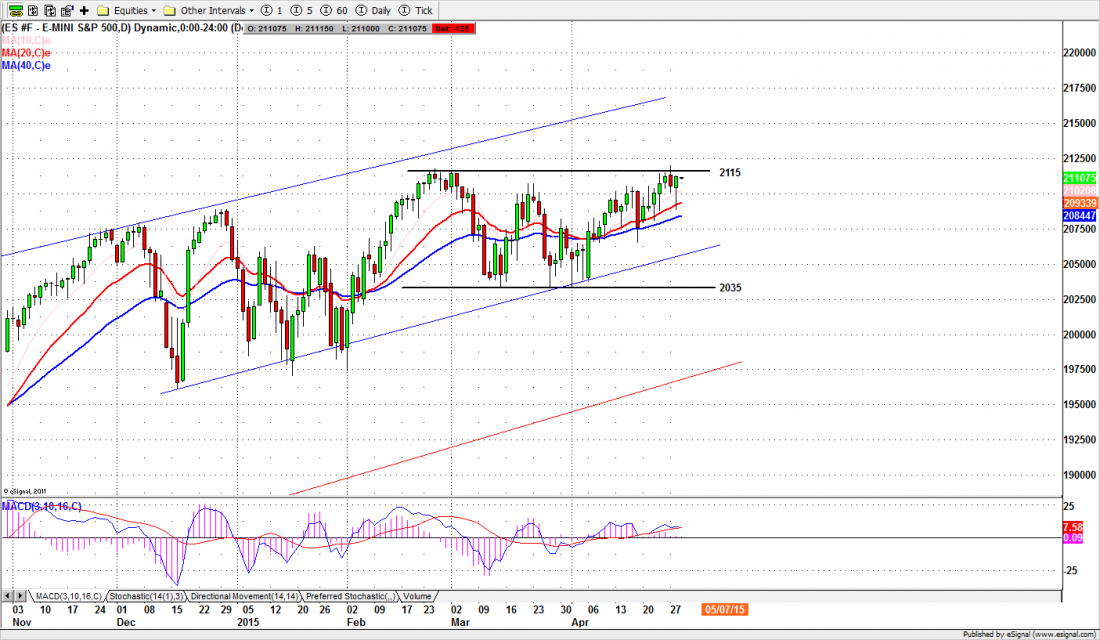

All of this back-and-forth is connected to the FOMC statement this afternoon and the jockeying for position at the end of the month. The minis have been trading inside a long rectangle (See chart) that goes back almost to the beginning of February. The last time the futures traded outside this congestion area was February 5.

We have been banging on the ceiling of this pattern for a week, and broke through briefly on Monday. Sometime soon the market will be forced to decide if this is the top. The consequences of that decision will be likely be felt all the way to the Fall

Today

Today (Wednesday) we have the Q1 GDP number and the FOMC policy statement at 2:00 p.m. As usual the machines will be parsing the commas and bouncing the market around for fun and profit, and we will be happily trading in all this drama. But at the end of the day we don’t expect it will amount to much, so far as the real world is concerned.

The ES has made several attempts to break out of the 2115-2117 area, and will likely give it another shot today. However we have some shorts trapped when the 2095 support was broken Tuesday morning and we may see a little pullback to give them a chance to escape before we rally again.

The low made yesterday below 2090 is likely to be the low for this week, especially as we move to the month-end window-dressing later in the week. But a break above the 2115-17 resistance zone could move the market up to 2123.50, and perhaps past that to 2130-35.Most of today’s price action will revolve around the FOMC announcement, and FOMC days are notoriously volatile. If you are not going to be there watching every tick, this is probably a good day to phone it in from the golf course.

Major support levels for Wednesday: 2088.75-85, 2075-71, 2062.50-64.50, 2055-56.50;

major resistance levels: 2123.25-21.50, 2129.50-32.50, 2138.50-39.50

###

Naturus.com publishes a free weekly analysis of US equity indices. You can get on the mailing list at this link.

For more from Polly Dampier: