Altera rallied to multi-year highs last month on speculation of Intel looking at a potential takeover offer for the smaller semiconductor company. Talks appeared to stall just a few weeks ago according to CNBC’s David Faber, but the most interesting part of this is that Intel reportedly was willing to pay $50+ per share to acquire them.

Unusual Options Activity

On top of this, post initial M&A rumors and the rejection, options activity has been bullish in the May and June monthly expirations. The ALTR May $44/$50 bull call spread was put on 5,000 times for a $1.80 debit on April 9th. On April 10th, the May $47/$55 bull call spread was put on 5,000 times for a $2.00 debit. On April 17th, the June $50/$55 bull call spread was put on 2,500 times for a $1.06 debit. More recently on April 29th, 6,000+ May 15 $47 calls traded with the majority being bought for $0.85-$1.30.

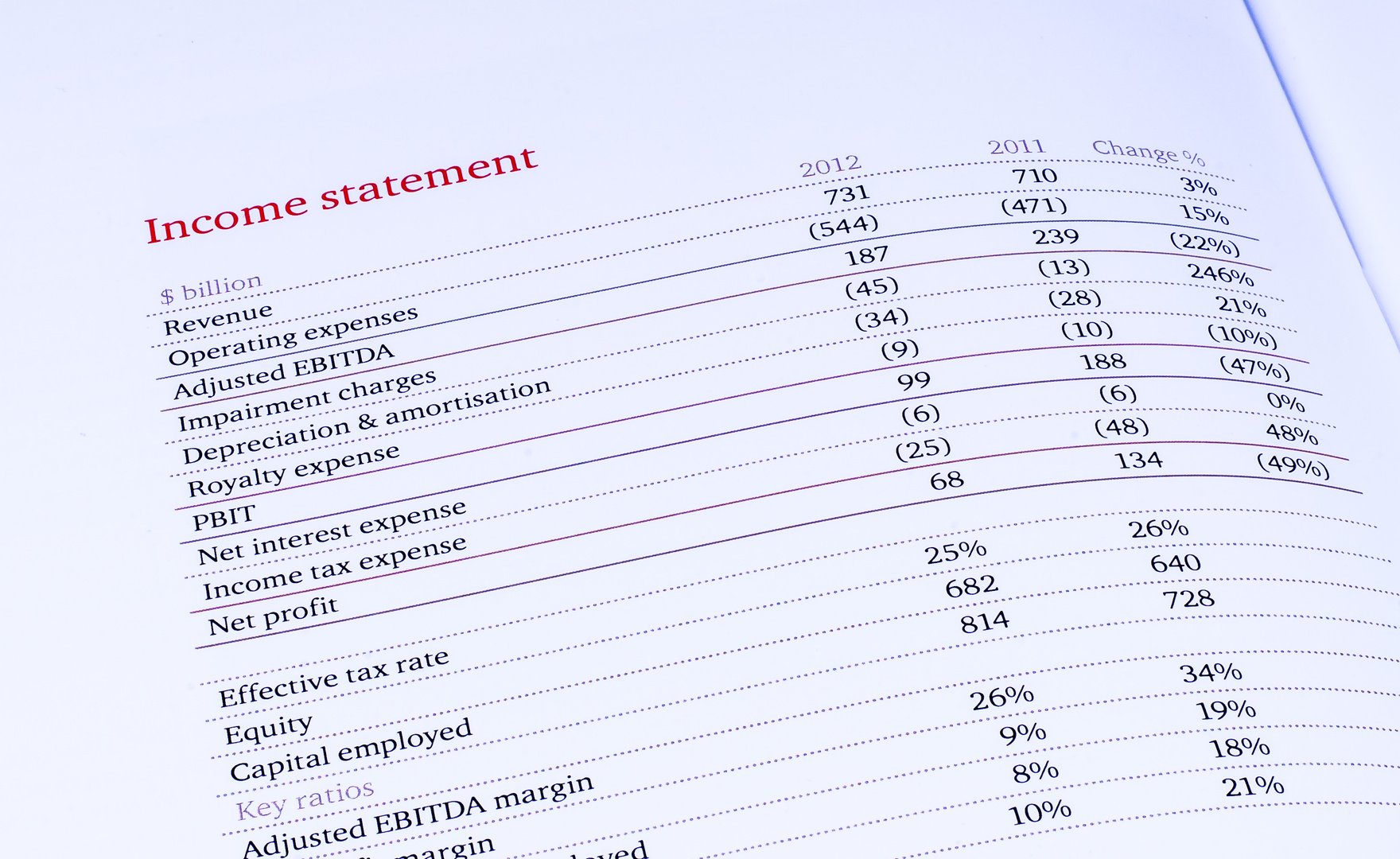

One factor that may change the thoughts of management at Altera is the fact that they missed Q1 Earnings per Share estimates, revenues estimates, and issued dismal Q2 revenue guidance (projected down 4-8%). At $50 per share it would value ALTR at 25.94x earnings (2016 estimates) and 7.80x sales (2016 estimates), both of which represent a more than fair offer for shareholders.

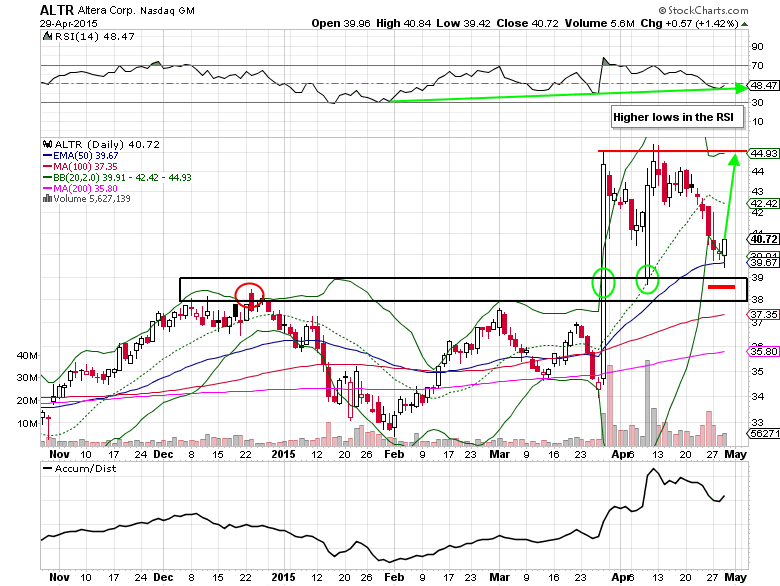

Following the breakout above the $38-$39 resistance level in March, shares of ALTR tested the new support level and quickly recovered. In the last two weeks the stock has pulled back once again, but was able to print a bullish hammer today at the 50-day EMA. This sets up for a low risk buying opportunity, using a stop loss under the April low of $38.67. Look for a minimum retest of the $45 resistance level in the next month.

Altera Options Trade Ideas

Buy the May 15 $40/$50 bull call spread for a $2.60 debit or better

(Buy the May 15 $40 call and sell the May 15 $50 call, all in one trade)

Stop loss- None

1st upside target- $5.00

2nd upside target-$9.50

Or

Buy the June 19 $40/$55 bull call spread for a $4.90 debit or better

(Buy the June 19 $40 call and sell the June 19 $55 call, all in one trade)

Stop loss- None

1st upside target- $10.00

2nd upside target- $12.00+

Disclosure: I may look at putting on one of these option trades soon.

####

To read Mitchell’s “Unusual Options Activity Report Featuring the SPDR Gold Trust ETF (GLD)” at OptionsRiskManagement.com, please click here.

More Articles from Mitchell Warren