Yesterday

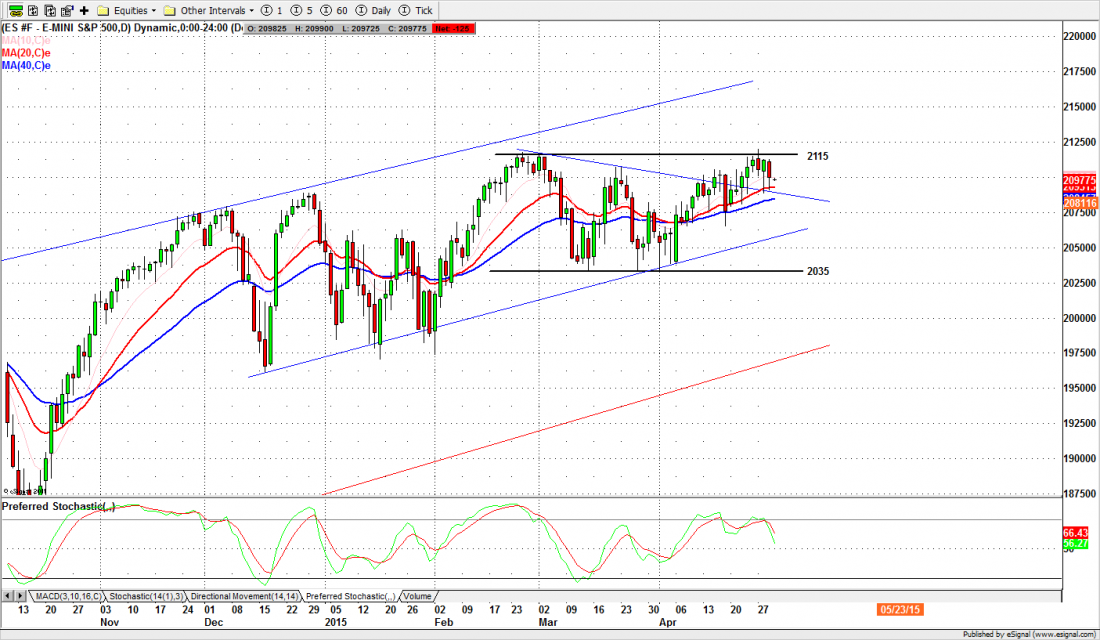

The S&P500 mini futures (ES) gapped down at the open yesterday (Wednesday) and stayed lower for the close. The first quarter GDP came in at 0.2% growth, well below expectations, in the morning session and even the usual Fed double-talk in the afternoon could not rescue the day. The June contract (ESM5) closed at 2099. This was a hair below to 2100 support, and a loss of 13 points for the day.

The ES has now pulled back into the wedge pattern it has been trying to escape and is suffering from a serious loss of momentum. It was knocking on the ceiling Monday; yesterday it was just drifting aimlessly. It is running out of time.

Today

Because today is the last day of April the 2090-2085 zone will be the key zone both bulls and bears will fight over.

The Bears have to fight to move the price down below 2085 to maintain the rectangle pattern. The Bulls have to fight to hold the price above 2090 to establish a double bottom that will set the stage for a move higher.

And the last trading day of the month will demonstrate the ability of large institutions to ‘paint the tape’ for a good close for the month. It may be noisy, but it will not have much significance beyond today.

ES could run up first and sell off later, or dip down first and bounce back up later. In either case the market could stay inside yesterday’s range (2112.50-2090) for most of the day and spike just long enough to shake out the weak hands… retail traders like us. And you.

Major support levels for Thursday: 2088.75-85, 2075-71, 2062.50-64.50, 2055-56.50;

major resistance levels: 2123.25-21.50, 2129.50-32.50, 2138.50-39.50

###

Naturus.com publishes a free weekly analysis of US equity indices. You can get on the mailing list at this link.

For More Articles from Polly Dampier