Yesterday

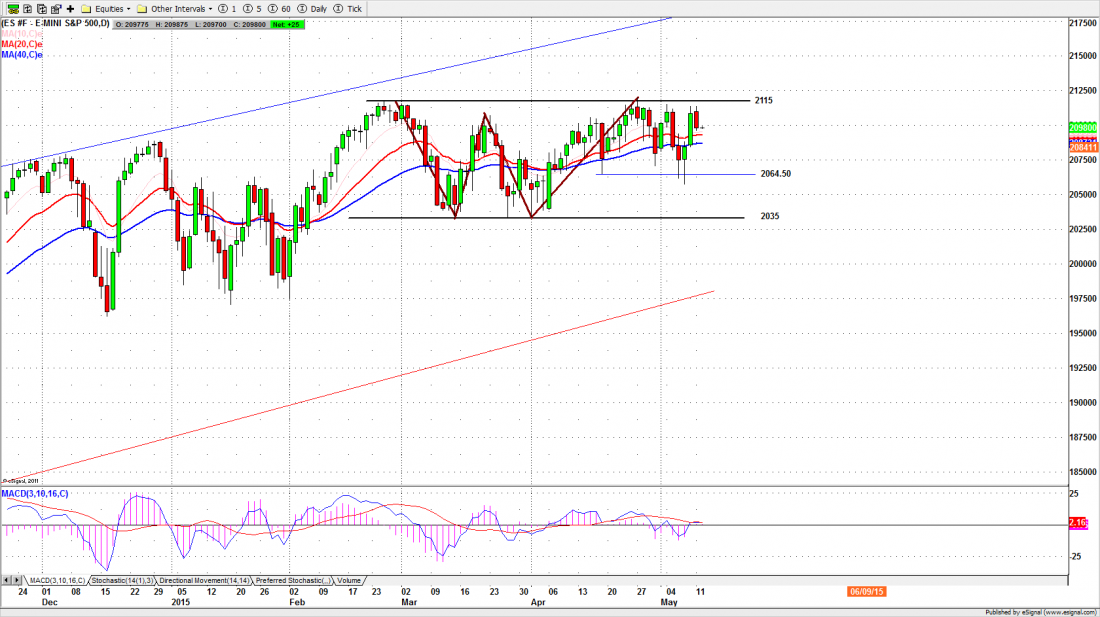

Monday we were looking for some follow-through from the previous week’s rally. It didn’t happen. The The S&P500 mini-futures, the ES, managed to struggle back to Friday’s high shortly after the open, but that was it. The futures then spend the rest of the session firmly in the red, despite an overnight rate cut in China that might have moved the market up a little, and closed at 2097.75, down about 11 points from the previous close.

The market just ran out of gas. The resistance at 2115 has been holding the futures down since the end of February. It is starting to look bulletproof.

Today

This is a slow week for economic data, so the machines that move the market around are looking elsewhere for some excuse – loosely described as “news” – to justify their continuing manipulation. Eh voila! Suddenly the Greek debt crisis is important again.

Today (Tuesday) Greece is scheduled to make a substantial debt payment. It there is a default the market could suddenly begin to move very quickly, and there could be wide price swings. Absent a default or some other dramatic news the movement is likely to be a slow grind downward, perhaps with a bounce near the end of the session or tomorrow.

We don’t think this has much to do with Greece. Last week the market rallied suddenly on Thursday, then opened a substantial gap from 2084 to 2102 on Friday morning. The sudden move left a lot of shorts trapped; they will be looking for a way out this week.

The starting point is close to the 40-day moving average around the 2087.50 level. The Bears will be looking for the market to return to that level to give them a chance to escape, and that might be the maximum retracement for today and tomorrow.

Major support levels for Tuesday: 2081.50-79.50, 2062-59.50, 2051.00-53.00, 2045-42.75;

major resistance levels: 2113.50-2115.50, 2123.25-21.50

###

For an Exclusive Free Weekly Analysis of US equity indices from Naturus, click here

Related Reading: