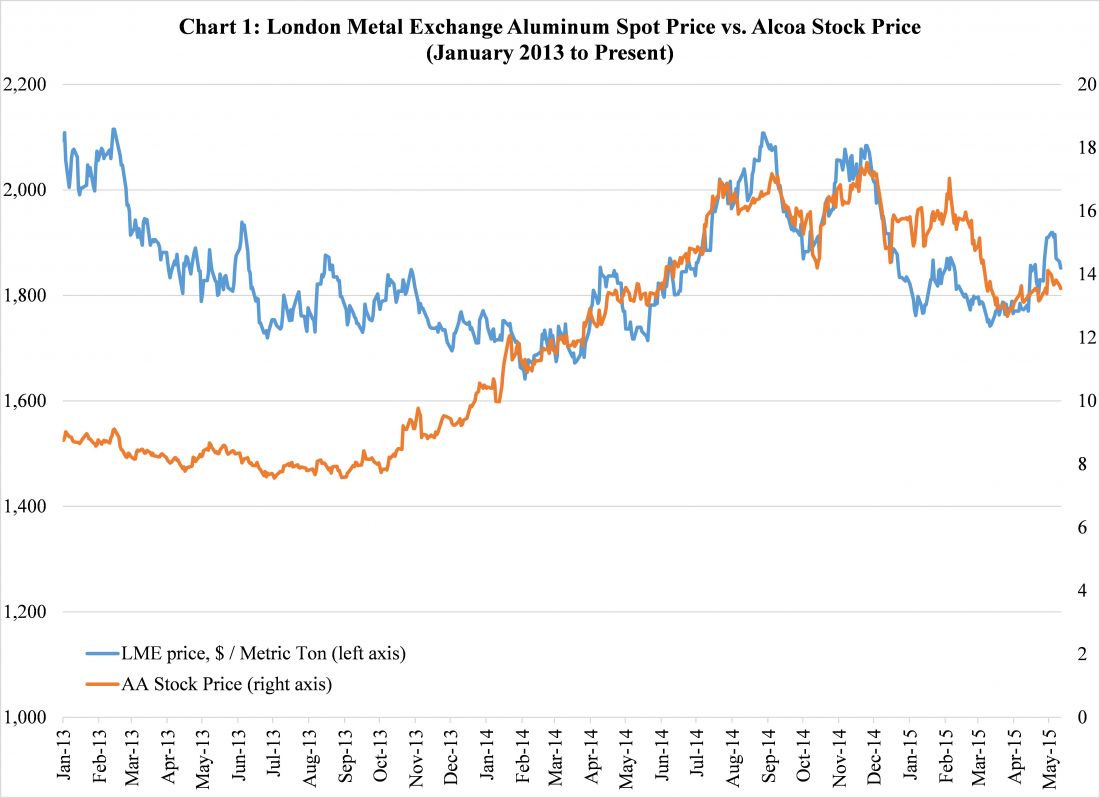

AA, the largest aluminum producer in the U.S., returned nearly 50% in 2014, as the combination of rising aluminum prices (along with rising regional price premiums over London Metal Exchange prices), efficiency gains, and a 7% growth in global aluminum demand drove AA’s 2014 net income to $268 million, its highest calendar-year profit since 2011. For the U.S. aluminum industry as a whole—taking into account the three largest U.S. aluminum companies, i.e. Alcoa (AA), Century Aluminum (CENX), and Kaiser Aluminum (KALU) as a proxy—total 2014 net income was $452 million. This was also the U.S. aluminum industry’s highest calendar-year profit since 2011, when aggregate net income for AA, CENX, and KALU registered $647 million.

Since the beginning of this year, however, U.S. aluminum stocks have generally struggled. On a year-to-date basis, U.S. aluminum stocks are down -7.6% (source: Morningstar), while AA is down -13.8%. This has been due to weak LME pricing and declining regional price premiums (e.g. the premium to the LME cash price for delivery to Rotterdam peaked at $500 a ton last November, and has declined to $150 a ton), which in turn have been attributed to: 1) a major reform in LME warehousing rules effective February 1st, reducing customers’ warehouse delivery times which increased short-term aluminum supply, and 2) an anticipated increase of Chinese aluminum exports, as the Chinese government removed all export duties on all domestically-produced primary aluminum and aluminum-alloy effective May 1st.

Despite the short-term supply glut, we believe the long-term outlook for global aluminum demand pricing remains bright due to strong growth in the commercial aviation market, the increased adoption of aluminum vs. steel in the automotive market, and an ongoing recovery in global commercial real estate construction activity. We believe AA is best positioned to take advantage of all these major trends; AA’s valuation also makes it a compelling value play. We like AA for the following three reasons.

- AA is gaining a cost advantage while the growth prospects for global aluminum demand remains bright

AA’s management team is successfully implementing a plan to reduce AA’s alumina and aluminum production costs relative to other major global upstream producers. While 40% of AA’s revenues are still derived from the sales of primary aluminum and alumina, AA has not historically been a low-cost producer in what is commonly regard as a commodity market. Since 2007, AA has reduced 33% of its smelting capacity (which converts alumina to aluminum), or about 1.4 million tons/year; AA is reviewing another 500,000 tons/year of smelting and 2.8 million tons/year of refining capacity (which converts bauxite to aluminum) for cut-backs. AA is on track to reduce its alumina (refining) cost from the 25th percentile of the global cost curve at the end of 2014 to the 21st percentile by next year; while reducing its aluminum (smelting) cost from the 43rd percentile at the end of 2014 to the 38th percentile by next year. Globally, other major aluminum producers, such as Rio Tinto (RIO), BHP Billiton (BBL) and United Company RUSAL, have already reduced and may be idling more smelting capacity later this year.

Despite the ongoing Chinese economic slowdown, the global outlook for aluminum demand remains strong. For example, the global automotive industry, which consumes over 20% of all aluminum, is still expected to grow at 2.4% this year, driven by low oil prices and an aging U.S. fleet (average 11 years old). In addition, the global commercial real estate market (construction also makes up over 20% of all global aluminum demand), outside of Europe, is still expected to grow. A recent report by Jones Lang LaSalle projected global direct real estate investment to grow at 5% in 2015; global office completions is projected to be one-third higher this year than 2014, and is projected to rise by another 10% in 2016. The strength in the commercial real estate market is confirmed by the latest rebound in the Architecture Billing Index, which has a 9- to 12-month lead on U.S. commercial real estate construction activity.

- 2. AA is transitioning to a value-added, industrial company

On the downstream side, AA has acquired two companies (Firth Rixson and Tital) and is acquiring one company (RTI) that will be complementary to AA’s existing aerospace businesses and transform it into one of the world’s largest aerospace supply chain companies—a high-margin business with already-contracted consumers such as Boeing and Pratt & Whitney. Specifically, Firth Rixson, a global leader in jet engine components will more than double AA’s engine revenue content. These three acquisitions combined will add $2 billion of revenues a year; growing to $3 billion of revenues over the next 5 years, driven by 9%-10% annual growth in the global aerospace industry as well as a global order book for commercial aircrafts that stands at 9 years.

- 3. AA’s valuations are attractive

AA is trading at an EV/Next 12 Months EBITDA multiple of 6.4, which is 13% cheaper than its 7.4 three-year average multiple from 2012-2014. With AA continuing to engage in a global cost-cutting initiative, as well as moving to higher-margin downstream markets, we believe AA’s EV/Next 12 Months EBITDA multiple should recover to its three-year historical average. We apply the 7.4 historical EV/EBITDA multiple to get a stock price of about $16 a share by the end of 2015.

Disclosure: Neither I nor does my firm, CB Capital Partners hold any shares in AA.

###

Visit http://www.cbcapital.com and http://www.cbcapitalresearch.com for more information.