The S&P500 mini-futures, the ES, had a wild day Tuesday. The current contract (ESM5) dropped 18.50 points in pre-market trading before the open, nominally in response to a sell-off in German bonds. It settled down after the morning session and recovered 95% of the early loss by the close. It finished the day at 2095.00, down just 2.75 points from the previous close.

This was pretty much the bailout move we predicted in Monday’s article. The news trading was mainly an excuse to help last week’s shorts escape from the Bear trap that snared them after the sudden strong rally Thursday and Friday.

But now that the Bears have slipped free, the shorts will be ultra-cautious. This still looks to us like a market trying to go up, not down, and a get-out-of-jail card like the one the shorts got yesterday is not likely to be handed out again. The sellers will be scared.

Today

The Retail Sales report will be released this morning before the market opens. If it is regarded as disappointing the ES may pull back temporarily somewhere near the 2084-86 area. But 2082.75 is a monthly pivot. Yesterday it held ES up well, and today we expect it will still hold up.

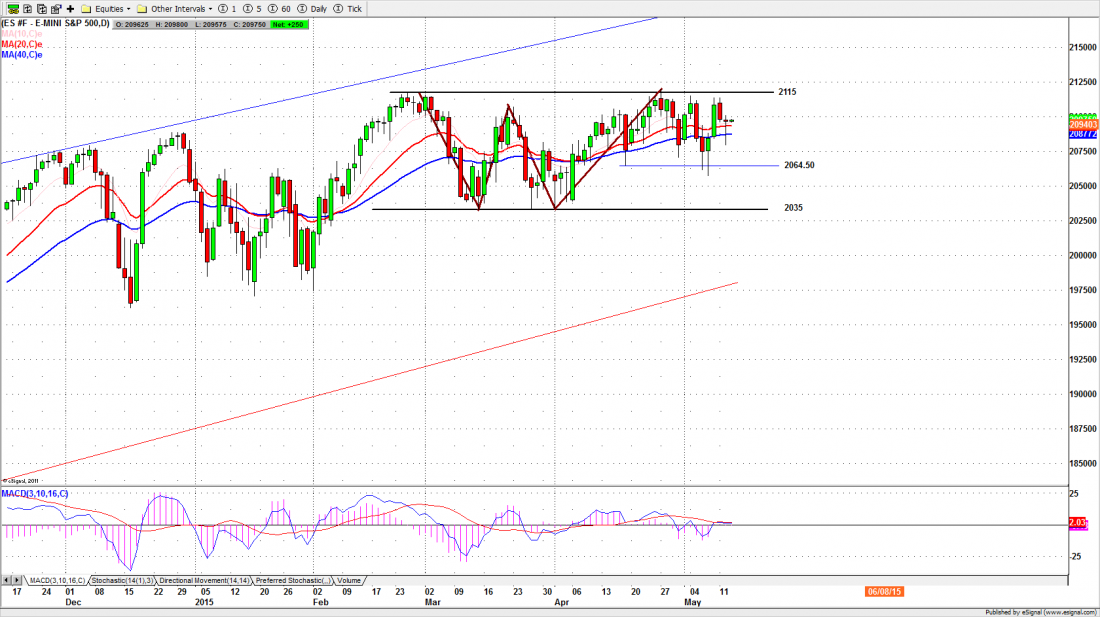

2113.50-11.25 is the first resistance zone. If ES can manage to open above it, we expect it will make new highs around 2121.50-24.50.

The futures formed a long doji yesterday by making a smart rally from a sudden drop. We think that move – and the price action in the past few days – sets the ES up for a breakout. The time is running out, but our bias is still to the upside. We will not be selling into any advance.

Major support levels for Wednesday: 2081.50-79.50, 2062-59.50, 2051.00-53.00, 2045-42.75;

major resistance levels: 2113.50-2115.50, 2123.25-21.50 and none

###

To receive Key Support and Resistance Levels Daily, Click Here