On May 5th, Novatel the $242M wireless solutions company reported that Q1 revenues rose 10.8% to $53.5M (mobile computing accounting for 83.4% of sales). They reported a small quarterly loss (in-line with Wall Street estimates), but are still projected to have a full year profit and build on that into 2016. One major positive was the 380 basis point improvement in non-GAAP gross margins to 24.8%.

Back in March, they acquired Feeney Wireless for $50M in cash and stock (paying less than 0.7x forward sales), which in their words makes a complete Internet of Things solutions and services leader. Novatel Wireless will be presenting at Cowen’s Annual Technology Media and Telecom Conference on May 27th. MIFI trades at a price to sales ratio of 1.14x and a price to book ratio of 6.87x.

Unusual Options Activity

More than 5,000 Dec $4 calls were bought for $1.17-$1.50 on May 13th. Call activity was 46x the average daily volume as implied volatility rose 8.8% to 71.62. Total call open interest was just 5,144 contracts prior to this action.

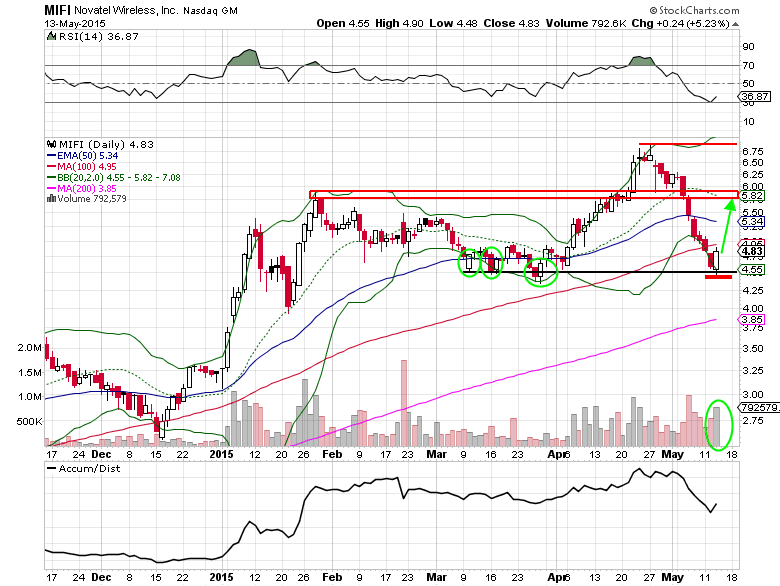

Shares of MIFI snapped a 7-day losing streak on May 12th (on heavy volume too), bouncing right at the $4.50 support level. Given the $2+ correction in the last 3 weeks, consider taking a bullish position now, using a stop loss under $4.48. At a minimum, look for a 50% retracement to around $5.68; possibly back to the April highs later this year.

Novatel Wireless Options Trade Idea

Buy the Dec $4 call for $1.50 or better

Stop loss- $0.65

1st upside target- $2.25

2nd upside target- $3.00

###

To read Mitchell’s “Unusual Options Activity Report Featuring Call Buying In The Junior Gold Miner ETF (GDXJ)” at OptionsRiskManagement.com, please click here

Related Reading: