Yesterday

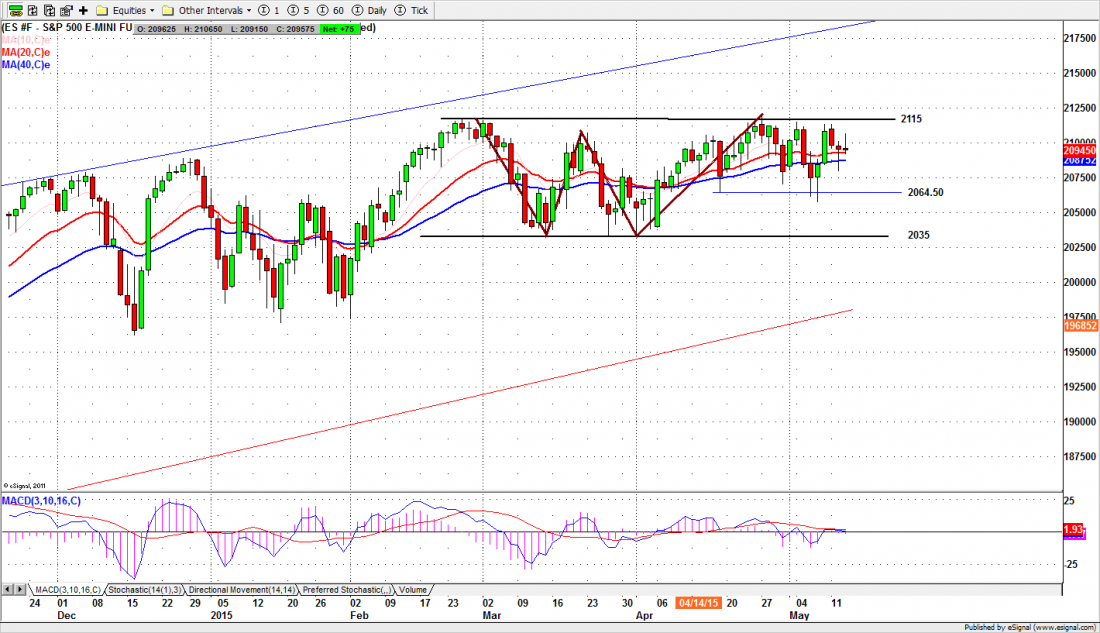

The S&P500 mini-futures, the ES, made a big move up at the open Wednesday, helped along by strong bond auctions in the past couple of days. It brushed aside doubts about weak Retail Sales released before the open, and rallied almost 10 points in the first five minutes after the open. It looked for all the world like the market was going to get the breakout traders have been waiting for since the beginning of March.

And then it dropped dead. The ES managed to make a high at 2106.50 and bump it a couple of times in the first half hour, but then the air just leaked out of the balloon for the rest of the day. By the end of trading the ESM5 (the June contract) closed at 2094.50, two ticks below the previous close.

Waiting for this breakout is starting to feel like California waiting for rain. What if it doesn’t happen? Maybe this is all there is?

Today

Today (Thursday) we will get the initial jobless claims report and the PPI before the market opens. Neither are expected to seriously move the market but we may have a little thrashing around.

Absent a real breakout movement, the ES should stay inside the 2121.50 to 2081.50 range. 2111.50-12.50 will be first intraday resistance line and 2088-86.50 will be first intraday support level.

2100 is the option game meanline – Puts and Calls are more or less balanced around that price – and this will be an intraday battlefield for both sides to fight over, We may see some traders closing positions and taking profits around that level.

Sudden runs up or down should be expected as the machines try to fake each other out. Humans should watch for opportunities to take advantage of the silliness.

Major support levels for Thursday: 2081.50-79.50, 2062-59.50, 2051.00-53.00, 2045-42.75;

major resistance levels: 2113.50-2115.50, 2123.25-21.50 and none.

###

To receive Key Support and Resistance Levels Daily, Click Here