Yesterday

Songwriter Cole Porter once asked rhetorically: “Is it an earthquake, or only a shock; is it the real turtle soup, or merely the mock.”

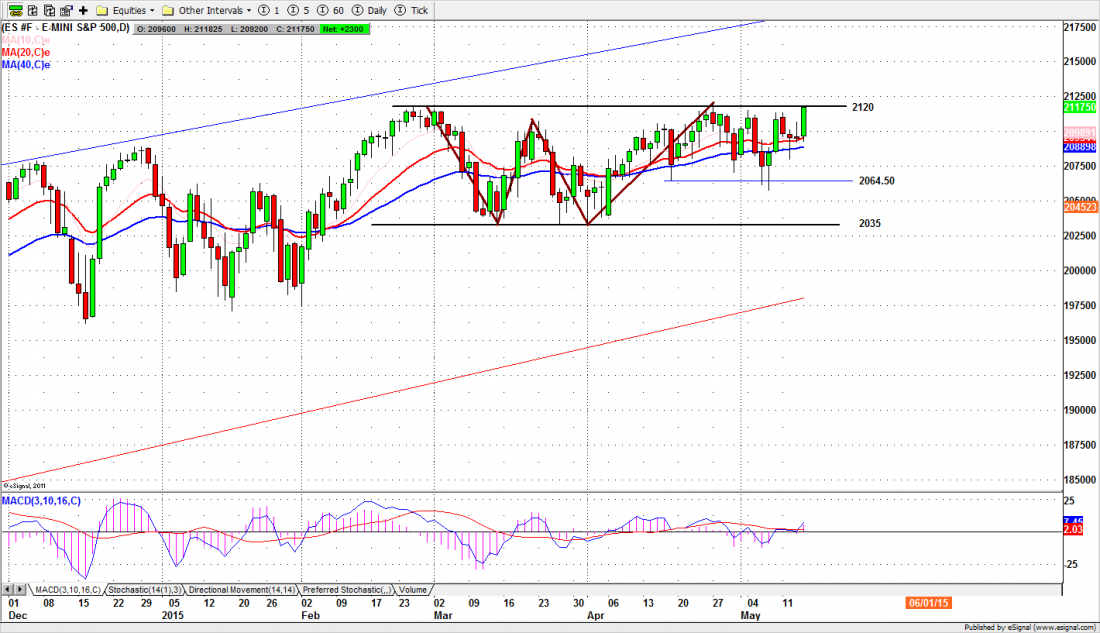

Traders are asking themselves the same question today after the S&P500 mini-futures, the ES, finally made a serious attempt to break out from the resistance that has been holding the market down since the beginning of March.

The futures took off before the market opened and never looked back. They opened 10 points above the previous close and closed at 2117.50, near the high of the day and just a couple of points below the all-time high set April 27.

So what happens next? Is this really the break-out we’ve been waiting for, or just another fake that quickly fades back into the same rectangular trading area?

Today

The June contract (ESM5) has now created a gap above the previous close, 2094.50. Today we want to see a strong volume on the upside to confirm that the breakout is real. Without it, ES still has a chance to drop down to fill the 2094.50 gap.

For a continuing upside movement the 2100-05 zone has to prevent ES from falling today.

2124.50-27.25 will be the first predicted intraday resistance zone. A break above it will be bullish and the buyers could push the price further up to the 2133-35.50 zone.

A failure to break that range could lead the price to go sideways within yesterday’s range while attempting to close yesterday’s gap at 2094.50.

One thing to watch will be the overnight price action. The futures have been making significant moves in the overnight trading when the volume is low. Often those moves are reversed when the day session starts and the volume increases but sometimes – yesterday for example – they set the direction the day session that follows.

Naturus publishes a daily trading plan that shows where overnight moves are likely to begin. Last night, for example, the trading plan identified 2091.50 as the possible low before a reversal up; the actual overnight low was just two ticks above that.

The major support levels for Friday: 2081.50-79.50, 2062-59.50, 2051.00-53.00, 2045-42.75;

major resistance levels: none established yet

###

Naturus.com provides customized weekly trading plans, to receive one for FREE, click here

Related Reading: