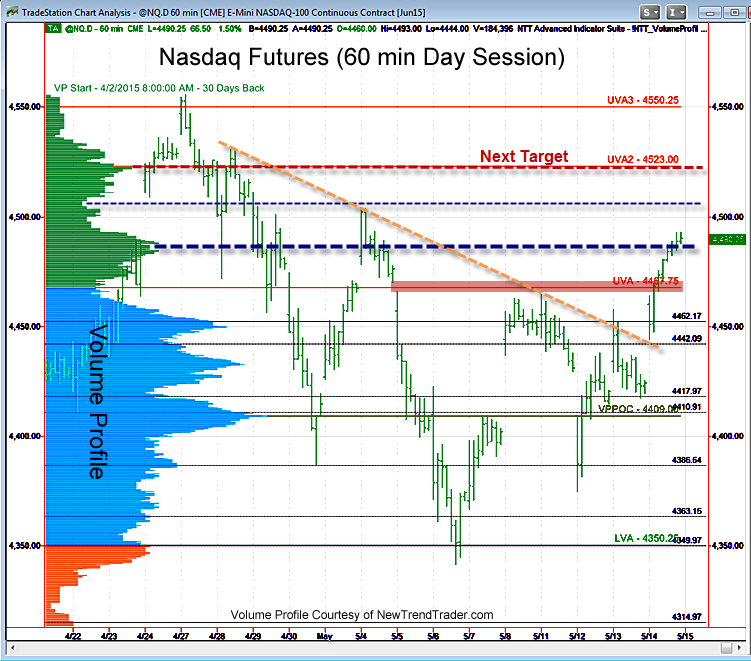

On Wednesday the Nasdaq futures gapped up, but did not make any progress as the index was caught in a big-picture compression pattern and the gap-fill police enforced a full retracement by the end of the day. I noted yesterday, however, that same-day gap fill action is bullish (an act of “good housekeeping”) and I set a continuation target in the area of the mini-gap at 4470 and into the Weekly Pivot levels around 4482.

On Thursday we were treated to the normal resolution of a compression pattern, namely expansion, which closed the 4470 mini-gap and even surpassed the Weekly Pivot target area (4476-4482). This move began in the overnight session, however, so it was difficult for some daytraders to catch.

This price action, of course, creates yet another target for the gap fill hunters. While a re-test of Thursday’s trendline break would be normal, the bullish action in the S&P and Dow suggests that the NQ might well attempt further advances before coming back to fill this technical void.

The next upside target is the High Volume Node at the UVA 2 level (4523).

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here: www.daytradingpsychology.com/contact

###

Don’t miss an exclusive webinar on May 26th at 4:30pm ET with Dr. Kenneth Reid Ph.D. that can change your trading and your life. A free Personality Test. To register, click here