A short strangle swap is something that works great in the theoretical world, but has a lot of obstacles associated with them. First, what is a short strangle swap? Think of it as selling a put calendar and a call calendar at the same time. A long gamma, short vega set up. For this to work, we need to have implied volatility come in precipitously and almost more importantly, we need to move. Direction does not matter. The big thing that smaller traders have to deal with is the margining of these types of spreads. Remember, you are long the front month options and short the longer term options. From your broker’s point of view, there exists the possibility that you allow the front month options expire which leaves you short the back month. The associated risk with the remaining short theoretically has unlimited risk. So, it is margined accordingly. Evan though it is never my intention to do this, the broker does not care. I signaled selling the DKS May/June 52.5/60 strangle swap at $0.85. Here’s the risk graph:

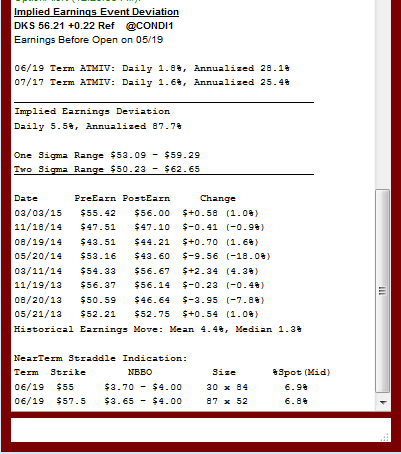

You look at this and probably think: “We should do this as many times as we possibly can! We can’t lose money!” Maybe, or maybe not. I have to have modeled the implied volatilities correctly first. Also, realize that we are going to be paying four sides of brokerage in and four out. That could really eat into my profits. But, I am holding a couple aces here. Let’s look at DKS’ performance on earnings:

We see that DKS has moved nearly 8% and over 18% over the past two years. If we get an outlier move, we are really in the chips! To sum things up, we probably make a little bit of money, but we have the outside chance of a real payday. Very low risk, potentially huge awards. You should take this type of set up every time!