Yesterday

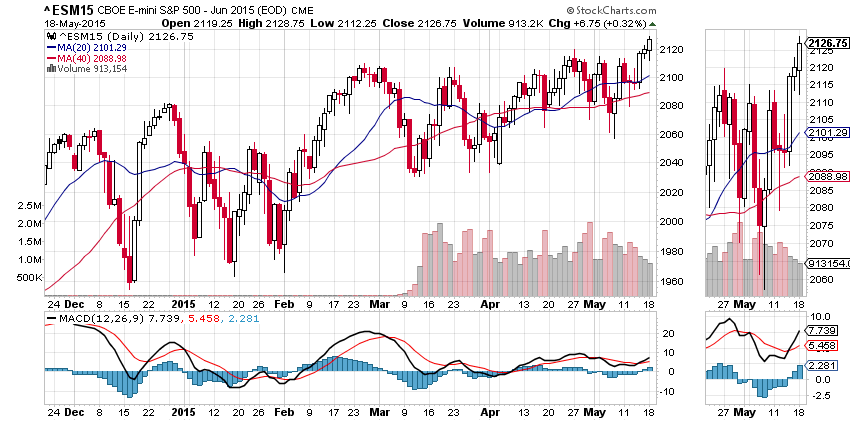

The S&P500 mini-futures (the ES) finally broke through the resistance area that has been holding them down since the beginning of March, and closed above the resistance at 2126.00, precisely the break-out we have been watching for all month. But there’s always something else, isn’t there. Now we are watching to see if the market can continue the rally over the rest of the week.

The price action was bullish. The ES dropped a bit in overnight trading, but moved up immediately once the day session started and stayed up all day long. It closed within two points of the high of the day, and seven points above the previous close.

A solid showing. The only flea in the cream was the volume, which has been declining for the last four days, and was about 40% below normal yesterday. Canada was closed for a holiday Monday, which may have weakened the volume, but Canada doesn’t contribute all that much to the ES. We’re coming into the part of the year when interest in the market wanes and the volume drops dead. If that happens now it may strangle this rally in its cradle.

Today

Today we want to see a continuation high to confirm yesterday’s breakout. The daily momentum support is lying in the 2101-2089 zone and MACD indicator still gives a buy signal. The market sentiment still is bullish.

If the ES can hold above the 2116.50-12.50 zone during overnight trading, it is likely to move up to 2136.50-44.50 area. But the 2136.50-44.50area is a 1.618% Fibonacci extension of the breakout leading to the 2088 to 1970 range. Some profit taking should be expected there.

Today and tomorrow could produce wild action with relatively large ranges. The ES may go up first in early sessions and sell off in later sessions. $VIX option will expire today and the FOMC minutes will be released tomorrow (Wednesday). Headwinds and tail winds are operating simultaneously and they are likely to swing the price back and forth.

Major support levels Tuesday: 2103-06, 2092-89, 2081.50-79.50, 2062-59.50;

major resistance levels: none

###

To receive free market insights with actionable strategies from naturus.com, click here