On May 20, cloud software developer Shopify (SHOP) will price its 7.7 million share IPO and open for trading the next morning. With the expected price range being bumped up to $14-$16 from $12-$14, early indications are that demand will be quite healthy for this deal.

The lead underwriters on the deal are solid, with Morgan Stanley, Credit Suisse, and RBC Capital Markets involved. This, combined with the smaller float, and SHOP’s very strong revenue growth, should create a recipe for a successful debut.

The two primary factors working against SHOP are its’ valuation and its’ track record of losses. More on that below.

Closer Look at SHOP

SHOP is a cloud software developer, providing an e-commerce platform designed for small and medium-sized businesses. The Shopify platform provides merchants with a single view of their business and customers across all of their sales channels and enables them to manage products and inventory, process orders and payments, build customer relationships, and leverage analytics and reporting. Merchants can also use Shopify Mobile, its iPhone and Android application.

It offers a vast ecosystem of app developers (over 900 apps available) and the Shopify platform’s functionality is highly extensible and can be expanded using its API and apps from the Shopify App store to offer additional sales channels, bolster features in existing sales channels, and integrate with third party systems.

As of March 31, 2015, SHOP had 162,261 merchants from approximately 150 countries using its platform.

The company still has plenty of room for growth ahead, too. According to AMI 2014, there were approximately 10 million merchants with less than 500 employees operating in its key geographies (US, Canada, UK, Western Europe, Australia, New Zealand).

Financials

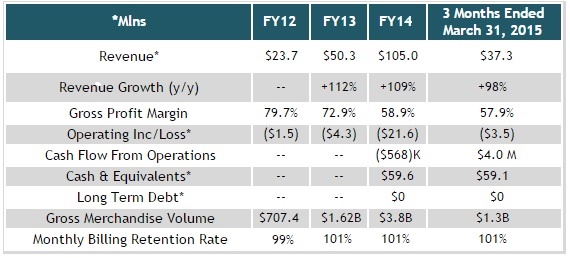

What immediately jumps off the page is SHOP’s revenue growth rates, at triple digits in FY13 and FY14, and nearly at that level for the first quarter of 2015. That’s the good news. The bad news is, despite the surging revenue growth, SHOP still hasn’t been able to post an operating profit.

One major reason for that is the dive in gross margin, which has slipped from nearly 80% to about 58% over the past couple of years. Cost of revenue has been escalating rapidly as operations and merchant support expenses associated with its data and network infrastructure have risen — primarily from personnel-related costs, such as salaries, benefits, and stock based compensation.

On a cash flow basis, the company did nearly break even last year and it generated $4.0 million in cash flow for the three months ended March 31, 2015. Its balance sheet is also in good shape with no long term debt and cash and equivalents of $59.1 million.

As for valuation, SHOP would have a P/S of roughly 6.5x annualized FY15 revenue, should it price at the mid-point of the proposed range.

Conclusion

There is plenty of reason to be optimistic about this deal. Its’ topline growth has been exceptional — in fact, the best I’ve seen in some time — which will surely be enticing to growth-oriented investors.

It’s also a smaller deal with just 7.7 million shares, and, the lead underwriters behind the deal are solid.

On the downside, gross margin has nose-dived over the past couple of years as the cost of revenue has rocketed higher. This, combined with rising operating expenses, has kept the company operating in the red.

The valuation is also a bit rich with a P/S of about 6.5x. And that’s based on the mid-point of the proposed range. If it prices above expectations and opens with a sharp pop, that valuation begins to look even more problematic.

Overall, though, from a pure growth perspective, there is a lot to like, and I feel it should generate some good interest because of the impressive revenue growth.

###

For more from Dennis Hobein including in-depth analysis of the IPO market and a scorecard of recent IPOs that includes a proprietary A through F grading system, visit the Next Big Thing.