Yesterday

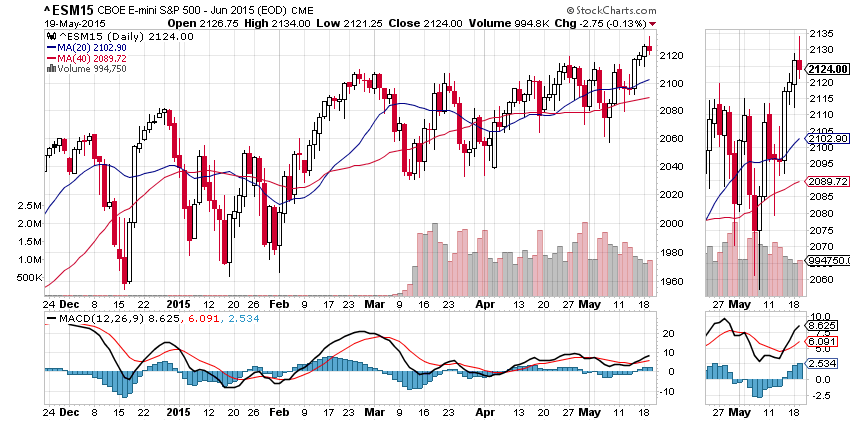

The S&P500 mini-futures (ES) reached historic highs in pre-market trading yesterday, but couldn’t hold the gain and closed at 2124.50, a bit less than two points below the previous close.

We’re in two-steps-forward-one-step-back mode these days. It’s nice to see a new high, and the breakout we’ve been waiting for since the beginning of March seems to have arrived. But yesterday’s price action was not the confirmation we have been looking for.

The ES rallied strongly in the overnight session, but it made the new high (at 2134) in the small hours of the morning — a pattern that is starting to appear frequently — when the volume was negligible and the pro traders are all safe in their beds. It makes us wonder if the Plunge Protection Team has added an early morning shift.

Once the day session started the market managed to claw its way up to 2130 — a new high for the day session — but dropped steadily after 2:00 pm eastern time and closed just a bit off the low. Volume was up a bit from the previous day, but still pretty anemic.

If the market climbs a wall of worry, we’re worried. Still Bulls, but still worried.

Today

Today the traders will focus on the minutes of the FOMC meeting to be released after lunch. The Street continues to worry that the Fed may choose to lift interest rate sooner rather than later, and that a rate increase will spoil the current rally. Traders are looking to the Fed to comfort their anxiety. Otherwise they are likely to start taking some of their chips off the table.

We still need to see some final confirmation that the breakout is real. A failure to return to yesterday’s high will lead the ES to drop and test the daily momentum support at the 2103-2106 zone.

If ES can hold above the 2116.50-12.50 zone during overnight trading, it has a chance to go back up to 2133.50-35.50 area, the Globex high. But we should expect to see some profit taking at that level.

Major support levels for Wednesday: 2103-06, 2092-89, 2081.50-79.50, 2062-59.50;

major resistance levels: none

###

To receive free market insights with actionable strategies from naturus.com, click here