On May 11, DISH Network reported first quarter EPS of $0.76 vs. the $0.40 Wall Street consensus estimate on revenue of $3.7 billion vs. the $3.73 billion estimate (+2.8% year over year). Average revenue per user (Pay TV) in the first quarter rose 4.4% to $86.01, but they lost 134,000 subscribers. DISH trades at a P/E ratio of 34.92x (2015 estimates), price to sales ratio of 2.14x, and a price to book ratio of 15.57x.

Given the tepid top and bottom line growth along with the DirecTV/AT&T merger (CEO Charlie Ergen says it will bring a harder fight for DISH), it could mean DISH is about to step in the M&A arena soon. In 2013 they tried to acquire Sprint for $25.5 billion (could look at T-Mobile?), but Verizon Wireless has been rumored as a potential buyer of DISH (for the time being it was denied last year). On May 13, Brean Capital maintained their buy rating and an $88 price target.

Unusual Options Activity

On May 18th, the June 19 $66/$70 bull risk reversal was put on 2,500 times for a $0.45 debit (involves buying the $70 call and selling the $66 to help finance the trade). There was large buying in the June 19 $70 calls on April 17th and 28th. Open interest was just 1,020 on April 17th, but now stands at 12,162 contracts. Also, on May 19th, 2,500+ May 22 weekly $69 calls traded (majority bought for $0.55-$0.80).

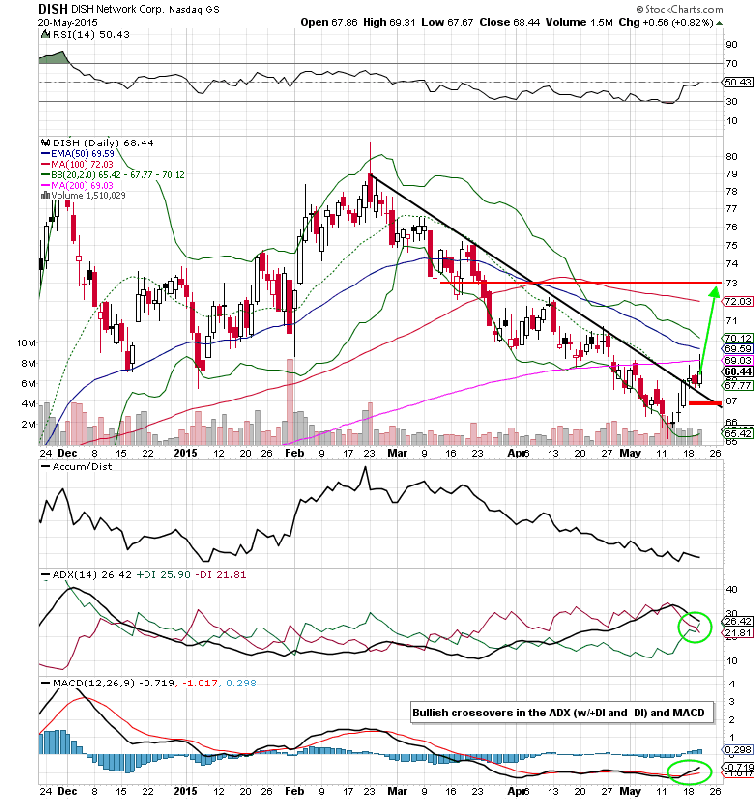

In recent days, DISH shares have started to move above the downtrend line from February and the middle Bollinger Band (currently $67.77). A 50% retracement of the Feb highs and May lows would put the stock at $72.94. Stop losses on a long position can be placed under $67 for a favor reward/risk ratio.

DISH Network Options Trade Ideas

Near-term

Buy the June 19 $68.50/$73 bull call spread for a $1.50 debit or better

(Buy the June 19 $68.50 call and sell the June 19 $73 call, all in one trade)

Stop loss- None

1st upside target- $3.00

2nd upside target- $4.45

Long-term

Buy the Jan 2016 $70/$80 bull call spread for a $3.50 debit or better

(Buy the Jan 2016 $70 call and sell the Jan 2016 $80 call, all in one trade)

Stop loss- $1.50

1st upside target- $7.00

2nd upside target- $9.75

= = =

To read Mitchell’s “Unusual Options Activity Report Featuring Call Buying In Omnicare (OCR)” at OptionsRiskManagement.com, please click here.