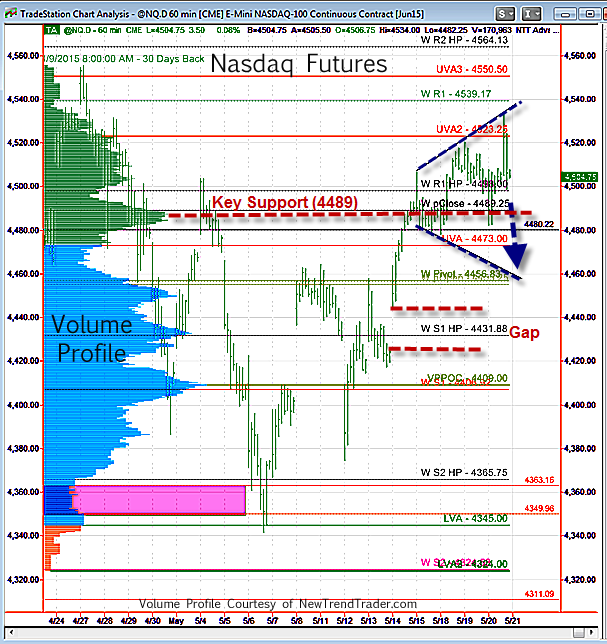

Thanks to the release of market-friendly Fed Minutes, on Wednesday afternoon the Nasdaq futures once again made a run at our upside target, the High Volume Node at 4523. The third time was a charm and it was briefly surpassed: 4534 marked the high of the day.

No doubt the zoom-up got some animal spirits pumping, but the bulls were soon left holding the proverbial bag. During the final hour of trading the Nasdaq fell 15 points during just one 5-min bar and closed 28 points off the high.

In recent days, the Nasdaq’s climb has been supported by the S&P 500 and the Dow Industrials, as they scout new all-time highs. On Wednesday, however, when profit-taking hit the Nasdaq, the broader market joined in.

The flip-flop price action leaves us with a potential megaphone on the hourly day session chart (blue dotted lines). If key support at 4489 is taken out (the red dotted line), then this would project an initial target at the Weekly Pivot (4456). If we get down there, the gap at 4425 would then be in play.

So once again, watch 4489.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here: www.daytradingpsychology.com/contact