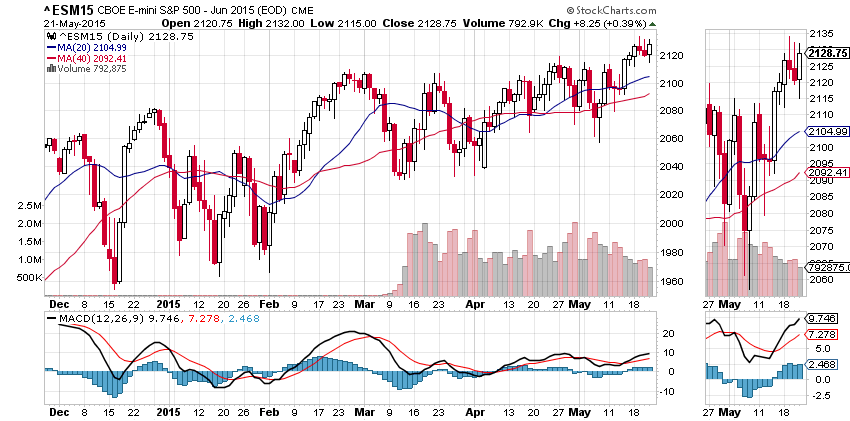

The S&P 500 mini-futures (ES) made a retracement move in overnight trading early Thursday morning, but stopped at the 2119 resistance area, and recovered during the day session to return to the previous day-time high at 2132. It fell back a little to close at 2128, about six points above the previous close, on very light volume.

We are still worried about the lack of volume in this rally, but the price action yesterday was a bit reassuring. In particular the ability to stay above the previous breakout point around 2119 fills us with hope.

The recent day-session high at 2132 is the next obstacle. We want to see the price move above it to keep the rally going. But we are still watching in vain for any sign of a build up in upside momentum.

Today (Friday) everybody will be picking over the bones of the speech the Fed Chair Janet Yellen is scheduled to give around lunch time. There may be some thrashing around once her remarks are released, but we don’t expect much real news.

The FOMC minutes released earlier this week make it pretty clear that a majority of Fed board members don’t want a rate increase before September, if ever. After that, you’ve said just about everything of interest the Fed can say. We aren’t expecting any big surprises. The aggressive buyers will continue buying on the dips; everybody else will still be a little tentative, which accounts for the light volume.

2119.75-2115 zone will remain a key zone for today’s trading. The close today must stay above that level to keep the rally alive leading into the Memorial Day holiday next week. We could see the ES could move up to the 2034-36.50 zone if overnight trading holds above 2126.50-25.50, but we expect a pullback from whatever high is made today for the weekly close.

Major support levels for Friday: 2103-06, 2092-89, 2081.50-79.50, 2062-59.50;

Major resistance levels: none established yet

Chart: ESM5 Daily Chart, May 21, 2015

To receive free market insights with actionable strategies from naturus.com, click here