Dow Theorists— we have a problem.

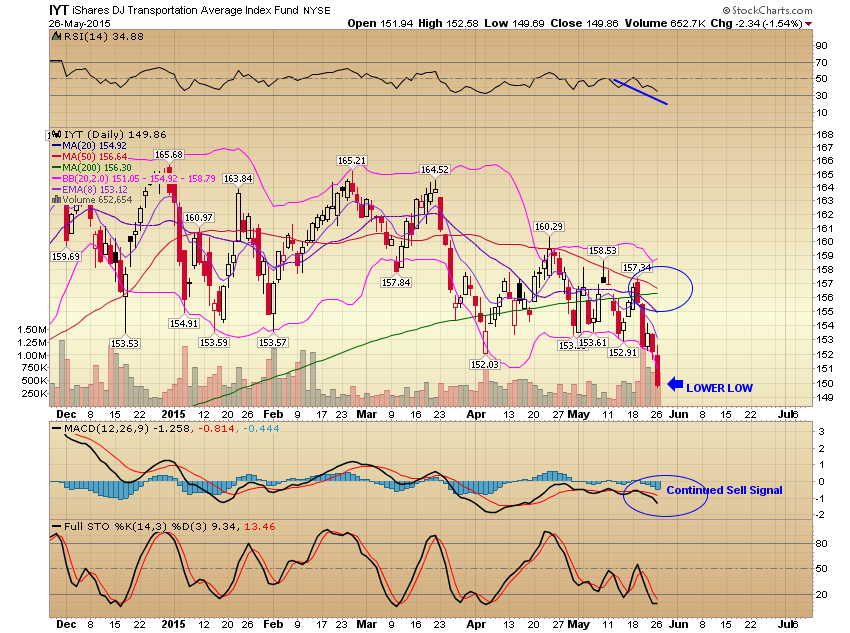

It appears to be the beginning of a larger move on the larger timeframe versus the ending move on a smaller timeframe in the iShares Dow Jones Transports ETF (IYT.)

A Little Background

The trouble started back in March 2015 where we started to produce lower highs after making a triple top in the $165 area. This was the first warning sign. The last attempt at breakout resulted in a selloff down to the 200 day moving average which produced a picture perfect bounce only to be faked out several days later as the IYT slipped under its 200 day moving average and chopped around for the next couple of weeks, making a lower low in the process. This was the second warning sign. As oversold readings were reached the IYT rallied again, only to make another lower high, capped by the 50 day moving average and this has remained resistance to this day, each touch of resistance creating a lower high.

Moving Average Picture

There are important developments in the short term and long term chart that bear heeding. The moving averages are out of order with the 8 day below the 20 day which is below the 200 day and today we are getting a cross of the 50 day down over the 200 day also known as the death cross. See the daily chart below of the IYT. Some would be tempted to call a bottom in the IYT as the stochastics are very oversold and we may well get a bounce, but that is a bounce that should be sold into, not bought.

I make this decision based on the monthly chart of the IYT which shows that we stagnated for 3 months at the top of the range, have a declining RSI, broke the 8 month EMA and have no support until the 20 week EMA which is around $145.39 currently. We are on a full MACD sell signal and have been for 3 months and the stochastics have just now broken the plane of overbought 80 and there is a long way down to the next potential real support which is the bottom Bollinger band or the 50 week moving average.

The other indices are going to have problems rallying without the support of the transports although we could simply remain range bound until conditions change. I would suggest keeping a sharp eye on the transports and take selective shorts on any rally. Currently you can get about $1.00 for the September 160/165 bear call spread.

Bottom Line

As a final note, portfolio protection is always prudent and you should look at it as the cost of doing business. It is not trying to “game the market”, it is meant for days like today where we wake up to a gap down open that only gets worse. If the market rallies your gainers will outweigh the protection, but on these down days it will help dampen the losses and give you some time to decide your further course of action.

Click here for a free e-book, Trading Stories from the Trenches