On May 27, EnerSys, a $3 billion industrial battery manufacturer, confirmed their Q4 results and Q1 guidance that was reported just a few weeks ago. EPS for the previous quarter came in at $1.15 on revenue of $629.9M. The stock trades at a P/E ratio of 14.97x (FY16 estimates), price to sales ratio of 1.17x, and a price to book ratio of 2.67x. EnerSys continues to grow earnings in the mid to high single digits on annual basis (mix of organic demand and buybacks). Since the market cap isn’t that large and they’re a more “under the radar name”, EnerSys doesn’t have much analyst coverage, but the average price target of those that do is $80.00.

Unusual Options Activity

On May 8, the June $70/$75 bull call spread was put on 2,500 times for a $1.50-$1.60 debit (part of a roll from the May $70 calls). Open interest has continued to build in these options and on May 27th, the trade was put on another 500 times for a $0.65 debit. Also, there were 750 June $65 puts sold for $0.90 and 500+ July $70 calls purchased around the same time. Total call open interest was 7,452 contracts vs total put open interest of 1,056 contracts.

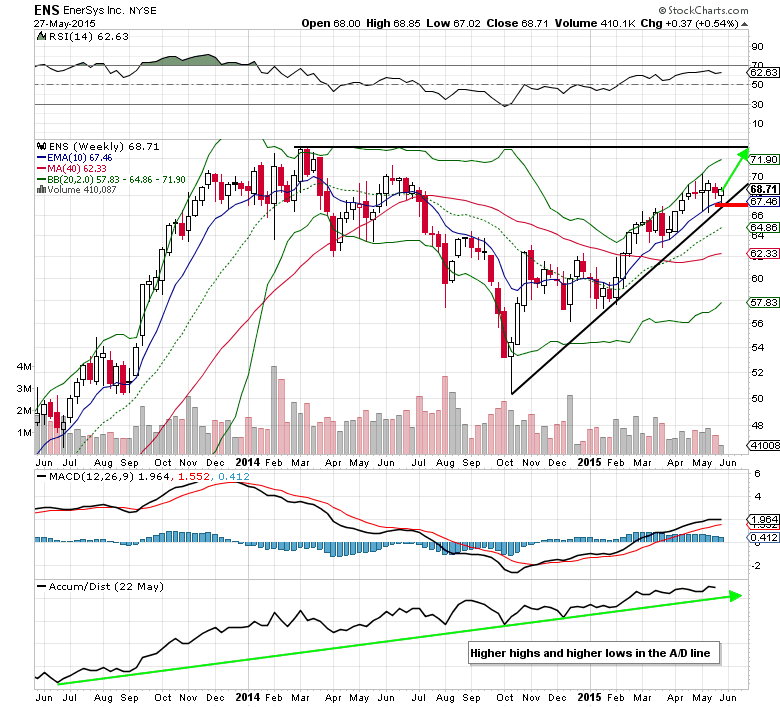

Looking at the two year weekly chart above, you can see shares of ENS are bouncing right at the 8 month uptrend line and the 10-week exponential moving average (AKA 50-day EMA). This gives traders a chance to step in with just under $2 of risk (stop loss on a stock position can be placed under $67). Going back to 2013 we can see major resistance is still in the $73.00-$73.25 range, which could take a few months before retesting and possibly breaking out above.

EnerSys Options Trade Idea

Buy the July $65/$70 bull risk reversal for a $0.75 debit or better

(Buy the July $70 call and sell the July $65 put, all in on trade)

Stop loss reference- A move below $67 in the stock

1st upside target- $1.50

2nd upside target- $3.00

Notes: This requires margin due to the short put component of the trade.