There’s a saying on The Street that anything obvious has no value. Perhaps the gap test-fill agenda was just a bit too obvious. Or, perhaps it was stunningly successful.

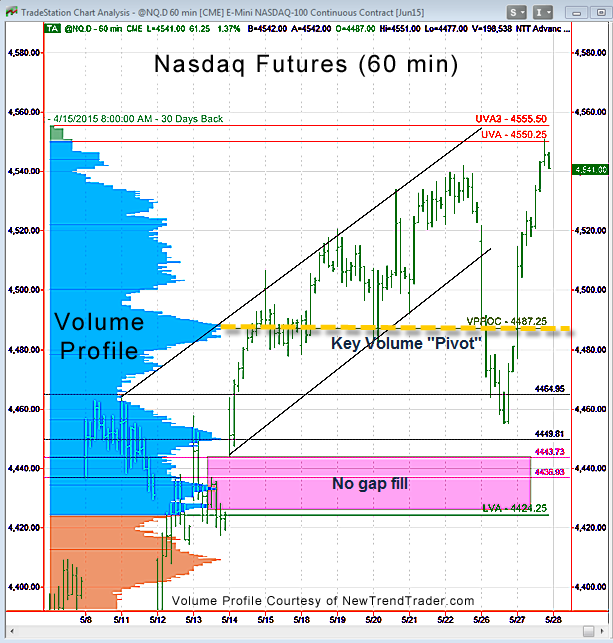

However one interprets it, the Nasdaq futures came within 11 points of the top of the 5/14 gap and then decided that was enough of a test, at least for now.

I noted in yesterday’s report that the High Volume Node around 4485-4491 had become key resistance and it was Wednesday’s spot to watch.

An 11-point, 5-min rally bar closing at 4495.75 at 9:45 am sent the unmistakable message that “Resistance is futile.” By the way, in the Nasdaq futures, the opening 15 minute range is a key measuring fractal (in other markets, other opening ranges matter.) If you trade the NQ, I recommend putting the 15 minute opening range on your charts.

So the “ultimate target” between 4425-4444 will have to wait. Interestingly, on this rally the Volume Profile Point of Control (VPPOC), which was formerly at 4409, has now moved up to 4487. This level, which is noted on the chart with a gold dashed line, is now the “Volume Pivot,” or “the market floor.”

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here.