On Tuesday the S&P futures closed a significant gap, a technical “incomplete” that had been lingering since 5/14. Once that gap was filled, the ignition event in the S&P triggered a parallel reaction in the Nasdaq futures, even though the Nasdaq was left with an unfilled gap. About 75% of the Nasdaq 100 is in the S&P 500, which explains the mirroring.

The S&P futures are basing in a bullish manner, as are the Nasdaq futures. As the most recent correction only lasted 5.5 hours, and dramatically rejected lower prices, higher prices are most likely in store for both indices.

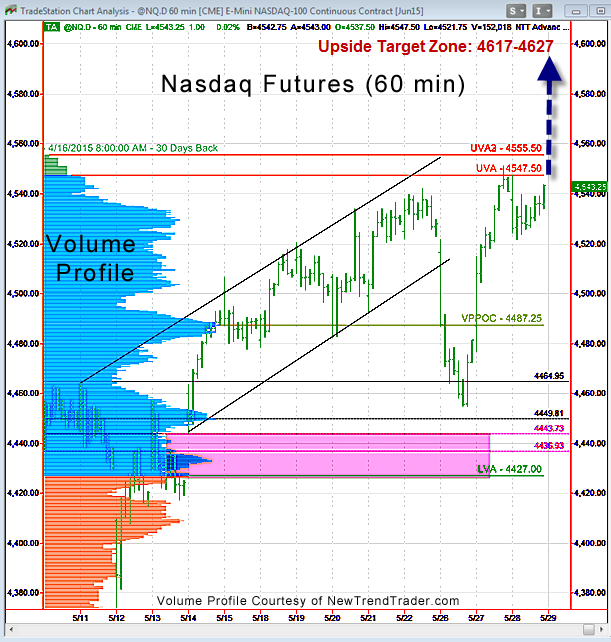

The target for the Nasdaq futures is 4617-4627. One can’t use Volume Profile for this calculation, so I used different tools.

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here