* Corn Stocks Highest in 28 years

* Planting ahead of schedule

* Bumper crop projected for October

As a call seller, you want to seek out weak markets that may not necessarily fall in price, but are unlikely to rally substantially.

The 2015 Corn market may fit this bill just fine.

The beginning of June finds farmers in states such as Indiana, Iowa and Illinois finishing up their 2015 corn plantings.

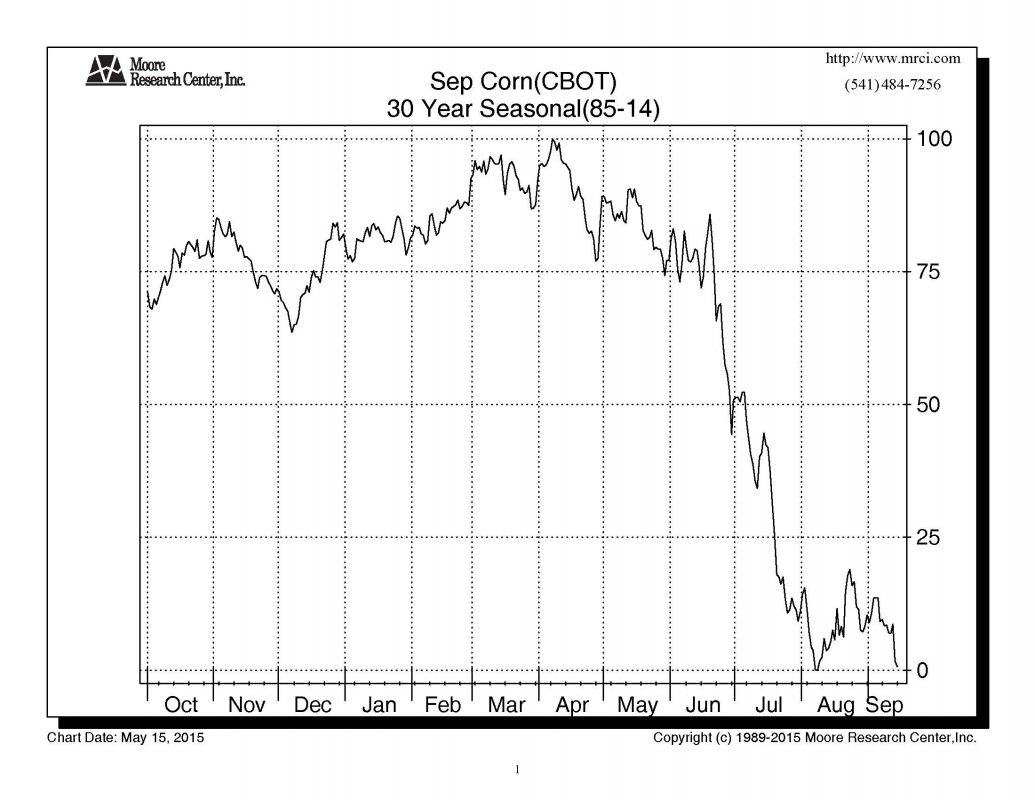

A typical pattern for corn prices would be for strength to build through planting season as trader’s anxiety ticks up over ever planting delay or weather report. Then, once a “premium” has been built, planted finishes. With the crop “in the ground” planting anxiety eases and prices have tended to weaken. (See Chart Below)

That hasn’t happened this year.

Corn prices have instead grown weaker through the spring planting season.

Why?

2 Reasons:

A. Huge yields in 2014 led to a bumper crop that produced a hoard of excess supply. Sales of the 2014 crop have been slow, allowing large quantities to remain in inventory. The March 1 Grains Stocks report shows the most corn in US storage since 1987.

US Corn Stocks are at a 28 year high

B. With nearly ideal planting weather this spring, planting progress for corn is well ahead of schedule. As of May 10, 75% of the US corn crop had already been planted. Last year at the same time, only 55% was in the ground. The 20 year average is to have only 61% planted by May 10. It is not uncommon for farmers to be planting corn into late June. And yet by the time you read this, the 2015 US corn crop should be all but in the ground.

Effect on Corn Price

This has led to corn prices not only not rallying in the spring, but weakening.

CBOT CORN: Corn prices have been declining from December through May

Bearish Fundamentals getting More Bearish

Those looking to buy corn at today’s lower price levels may want to think again. Corn fundamentals are not getting any better. The US is expected to plant 89.2 million acres of corn this year. This is a slight drop from 2014’s 90.6 million acres but still enough to yield an impressive crop should average yields come to pass. Last year’s ideal growing conditions saw an acre of corn produce 171 bushels of corn. The USDA has assumed a more “normal” yield this year of 166.8 bushels per acre. Assuming this is realized; ending stocks for the 2015/16 crop will have a good chance of approaching this year’s whopping 1.851 billion bushels – the highest in nearly a decade.

Even average corn yields this year would make 2016 ending stocks the 2nd highest in a decade.

While daily prices will ebb and flow, we feel the corn market is unlikely to mount a significant longer term rally with this kind of burdensome supply pressing down on it.

Think of yourself sitting on the ground and Hulk Hogan sitting on your shoulders. Do you think you could stand up? Probably, but you’re going to need one heck of a reason to do so. Corn has the hulk of supply on its shoulders right now – and we don’t see a reason strong enough to counteract that weight any time soon.

Wildcards

The situation, of course, could change. There are two factors that could alter corn fundamentals either in favor of the bulls or the bears.

1. Weather – US weather is always a factor in grain prices in the summer. While true weather events are surprisingly rare, they do happen – occasionally. Corn will be most susceptible to adverse weather during pollination. This typically occurs in late July. A weather event could change the momentum to the bulls.

2. Bird Flu – A media favorite, bird flu appears every few years in the US. However its effect on corn prices is often just a big “if” that never comes to pass. That being said, it always holds the potential to be a factor. A severe bird flu outbreak in the US could not only mean millions of slaughtered birds in the US, it could mean US consumers turning away from poultry. That means less demand for corn. Dennis Gartman thinks bird flu could be a big deal this year but we will take a wait and see approach. A major outbreak would be another bearish force for corn. So far, only limited outbreaks have been reported in Wisconsin and Iowa.

Conclusion and Strategy

With burdensome old crop stocks on hand, a fast start to the growing season and projections for another big crop in 2015, supply side fundamentals seem to be heavily in favor of the bears. A significant weather event this summer could change that – but there are no signs of such an event thus far. In reality, crop damaging weather, while always a possibility, is uncommon.

This being the case, call sales in corn should serve investors well this month. The corn market is currently oversold and a limited rally, short covering or otherwise (i.e.: media driven), could be an opportunity for selling overpriced call options.

OptionSellers.com suggests the September 4.40 calls but only on a rally driving premiums to $400 or better. Aggressive traders can sell the 4.20 calls for $400-$500.

A mid-summer weather rally could be opportunities for building positions in the further out December contract with deeper out of the money strikes and higher premiums available. Corn is most susceptible to weather during pollination in late July.

We’ll be pricing both September and December call premium for our portfolios over the next 2-8 weeks.