June, It’s already June 1st. The winter was fairly mild. Spring has been quite mild. Most of the crops are in and generally benign weather is being called for throughout the rest of summer. There has been very little then to spur domestic demand for natural gas. As a result of this, we’ve been watching the bearish pattern develop. We’ve also used the combined actions of the commercial traders along with seasonal forecasts by Moore Research to develop successful trading plans. The natural gas market is another one that currently fits the criteria of a bearish seasonal outlook along with a bearish forecast by the commercial traders.

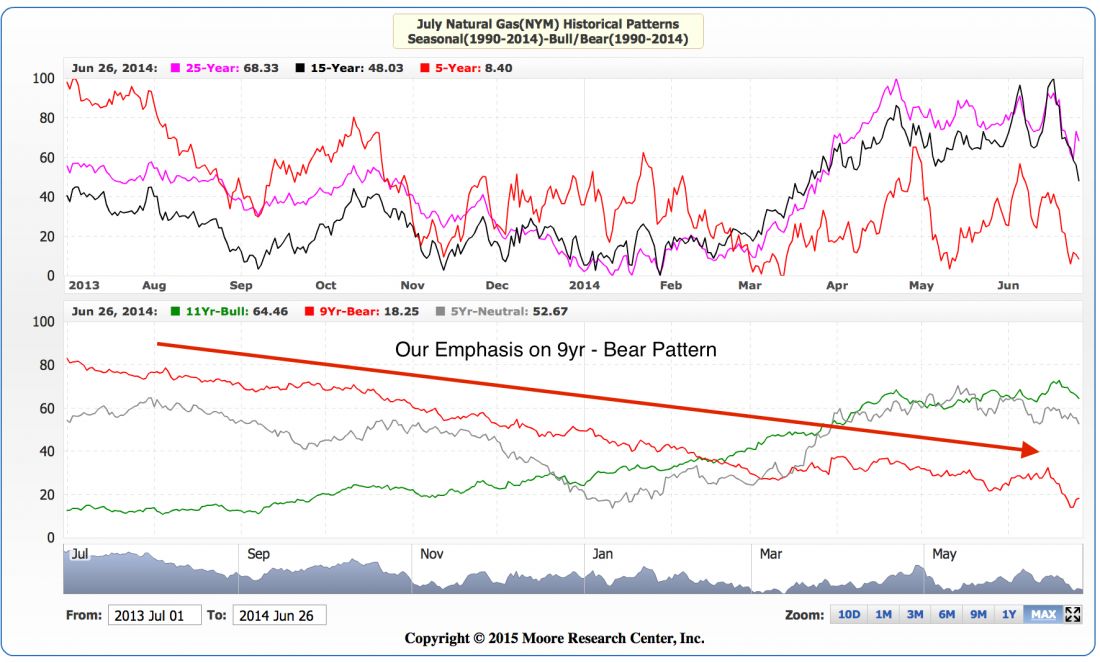

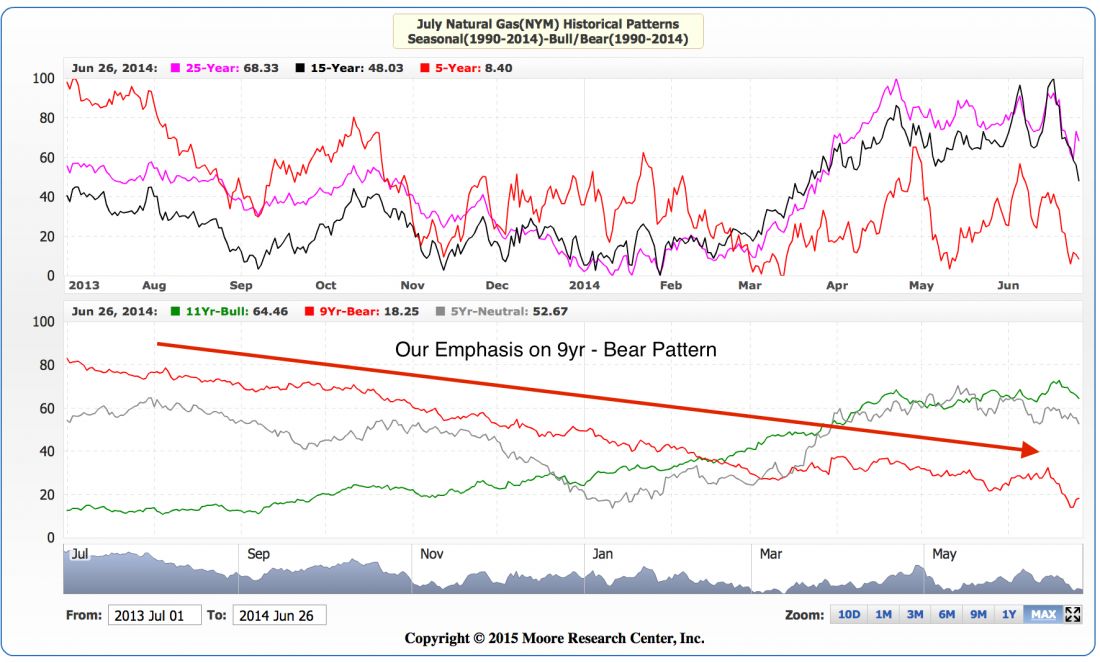

We’ll begin with the seasonal background as provided in the chart below by Moore Research. One nice feature about their charts is that they provide the evolution of the market’s seasonality as well as its current state. Typical seasonality for the July natural gas contract is to exhibit some strength as we shift from March and April’s spring into May and June’s early summer expectations of additional electricity demands based on cooling needs. However, this spring’s mild temps have created very little in the way of energy demands. Therefore, the seasonal pattern for July natural gas is far more similar to the evolving bear patterns in both the 5 year, on top as well as the 9 year bear pattern which we emphasized in the lower pane of their chart.

Moving to the second part of our analysis, we use the commercial traders’ actions within the market as a proxy for providing fundamental expectations of the market. The commercial traders have access to better information, models, algorithms etc. than we as individual traders will ever hope to have at our fingertips. Furthermore, commercial traders are value traders. Watching their actions, especially the speed of their actions can tell us a lot about the importance of a given price level.

Putting this to work in today’s market shows that commercial traders were significant buyers of the low volatility bottom building into spring. The frightening aspect for the natural gas industry is that the commercial traders used the anticipated spring rally to sell everything they could. Commercial traders have been net sellers in each of the last four weeks to the tune of more than 60,000 contracts. The intensity of this selling has pushed their momentum into negative territory and puts us on the lookout for selling opportunities like the one we published on May 20th in our discretionary COTSignals nightly email.

The dramatic commercial selling on the spring rally they had anticipated leaves the natural gas market in danger of seriously penetrating the $2.50 support to which it has been clinging. Thus, we like the current position and have lowered the protective buy stop to breakeven. Natural gas hasn’t been this cheap since the early 2000’s and we don’t think it’s washed enough people out to form a meaningful bottom. Ultimately, it’s just one more commodity market dealing with excess capacity.