The great thing about trading options is there are no limits to the number of strategies, or degrees of risk and reward. Depending on how an option strategy is structured, it can be a simple lottery ticket (buy a cheap call or put outright), a limited risk range trade, a premium collection effort, or a “free” trade in which the trader accepts theoretically unlimited risk for the prospects of a directional bias without any cash outlay. In this article, we’ll focus on the latter.

FREE Option Trades!

People love the idea of free, but most fail to acknowledge that the word free is typically synonymous with the phrase “strings attached.” When retailers offer free merchandise, they generally require you to purchase something else or perform some sort of task. A free trade is no different.

When you hear a trader refer to a free option trade he is speaking of a scenario in which an option spread trader pays an equivalent amount of premium for the long options of a spread, relative to the premium collected for the short options. In other words, it is a trade that requires no cash outlay because the premium paid and collected for each leg of the spread resulting in a wash. The strings attached to this type of free venture, is theoretically unlimited risk beyond the strike price of the naked short options and a margin requirement. Let’s take a look at an example of a specific type of option spread that can often be executed at “even money” (a free trade).

Bull Call Spread with a Naked Leg

A bull call spread with a naked leg is essentially the practice of financing the purchase of a vertical call spread with the sale of a put. If you aren’t familiar with the term vertical spread, it is the purchase and sale of two call options in the same market and month, but with differing strike prices. The buyer of a vertical spread would be purchasing the option with a strike price closer to the current market price (the expensive option), and then selling the option with a distant strike price (the cheaper option). The buyer of a vertical spread pays money to enter the trade, but the seller of the spread collects a premium in exchange for risk.

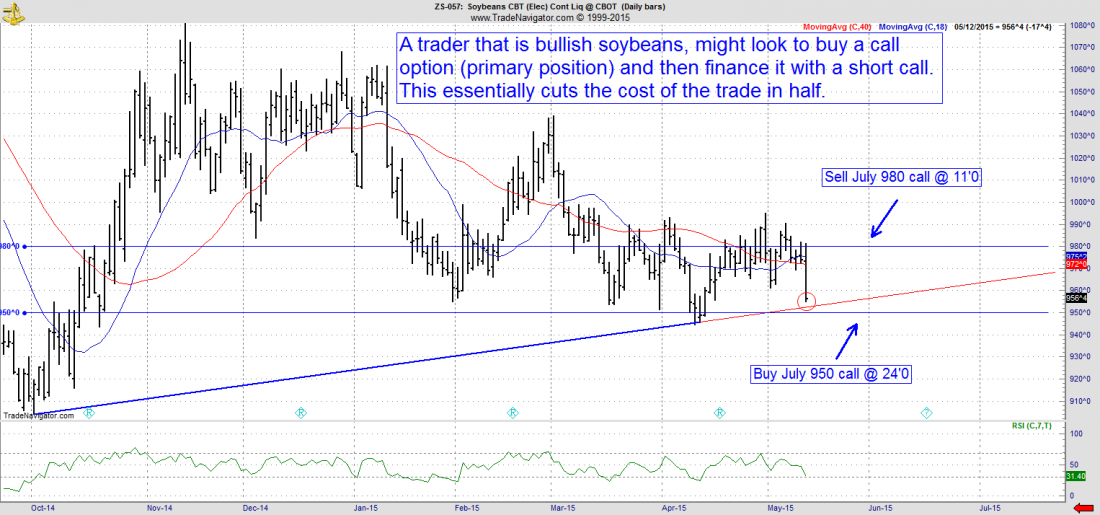

To illustrate, let’s take a look at an example. A trader that is aggressively bullish soybeans with the market trading near $9.56 per bushel might look to purchase a near-the-money call option with a strike price of $9.50. This option alone will be very expensive, in our example we’ll assume the cost is 24 cents or $1,200. Most traders would agree that spending over $1,000 on a single option isn’t necessarily an attractive venture. After all, the market would have to be above the strike price of your option by 24 cents just for the trade to break even. Perhaps a better way would be to sell a $9.80 call for about 11 cents. This essentially cuts the cost of the trade in half. The total cost and risk of this new trade, known as a vertical spread, or a bull call spread, is now 13 cents or $650 ((24 – 11) x $50)). This is also the total risk of loss.

The new trade offers a break-even point of $9.63 ($9.50 + .13); this is the strike price of the option plus the premium paid for the spread. The price of soybeans must be above this level at expiration for the trade to be profitable. If the price of soybeans is above the strike price of the short call ($9.80), the trade returns the maximum profit of 17 cents to the spread holder, equivalent to $850. This is calculated by taking the distance between the strike prices of the spread, minus the premium paid and then multiplied by $50; (($9.80 – $9.50) – .13) x $50)).

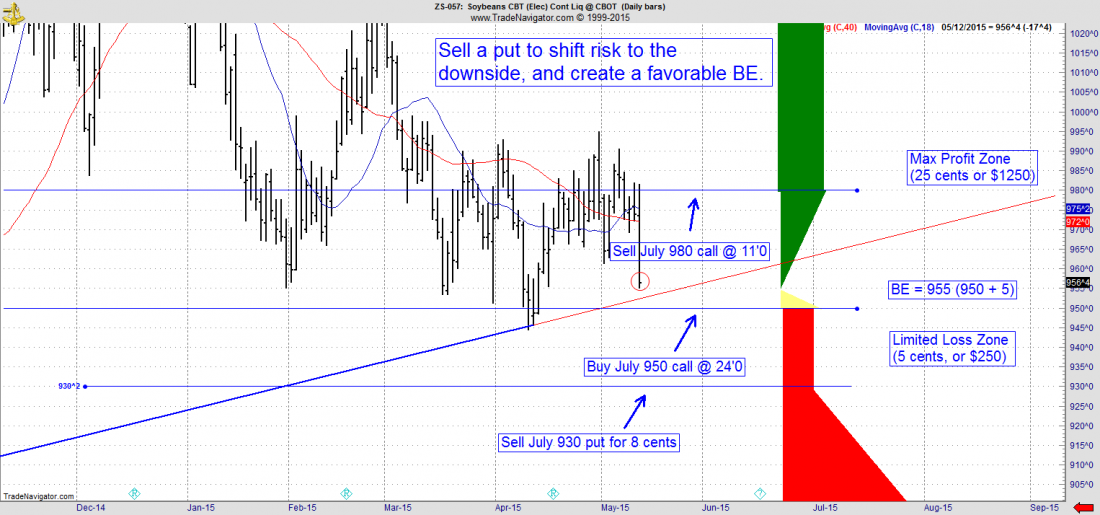

Risking $650 to potentially make $850 is better than the original risk and cash outlay of $1,100, but the prospects can be dramatically improved with the sale of a put option to help cover the cost of the long vertical spread. In this example, a trader might have been able to sell a $9.30 put for about 8 cents to cut the total cost of the trade to 5 cents, or $250. This isn’t a free trade, but the ability to purchase an at-the-money call option for $250 rather than $1,200 is a big advantage. Not only does the sale of the put reduce the cost of the trade, but it creates a more favorable break-even point. Simply put, rather than having to make up 13 cents to cover the cost of the spread, the price of soybeans only has to be 5 cents above the strike price on the long call to return a profit to the trader. This alone, shifts the odds of success in a positive direction.

Another benefit of the lower trade cost is a larger potential profit. Because the cost of the trade was reduced by 8 cents, the profit potential was increased by 8 cents. The new version of the trade now offers a max profit potential of 25 cents, or $1,250. To reiterate, adding the additional short put enabled the trader to shift a trade that originally cost $650 to potentially make $850, into a trade that costs $250 to potentially make $1,250.

The catch

The drawback of selling a put to pay for a vertical spread is theoretically unlimited risk below the strike price of the put. In other words, if your assessment of the market is completely wrong and the futures price drops below the strike price of your short put, it is similar to being long a futures contract in that losses can accumulate quickly and are theoretically unlimited. However, unlike being long a futures contract there is a considerable amount of room for error in that the price of soybeans would have to drop over 20 cents from the entry price for the position to be as dangerous as being long a futures contract. Trading naked options isn’t for everyone, but there are certainly some compelling advantages!

*There is substantial risk in trading options and futures. It is not suitable for everyone.

Carley Garner is the Senior Strategist for DeCarley Trading, a division of Zaner, where she also works as a broker. She authors widely distributed e-newsletters; for your free subscription visit www.DeCarleyTrading.com. Her books, “A Trader’s First Book on Commodities,” “Currency Trading in the FOREX and Futures Markets,” and “Commodity Options,” were published by FT Press.