Earlier this week, Apple announced Apple Music on the day of the WWDC keynote address. This $9.99 per month service will compete against the likes of Spotify, Sirius XM, and Pandora. Along with the new service they unveiled the Apple Watch in the 1st quarter, which sold over 1M units in the first few days on the market. It is also important to note that we are just a few months away from another iPhone refresh cycle. The stock tends to perform well leading up to these events.

The $742B tech giant trades at a P/E ratio of 14.30x (Sep2015 estimates), price to sales ratio of 3.46x, and a price to book ratio of 5.69x. The multiple isn’t expensive when compared to the broader market and especially isn’t when you factor in the expected 40% EPS growth and 27% sales growth for this FY. Apple also has a respectable 1.61% dividend yield and raised their share repurchase program to $140B from $90B in April. Yesterday, Morgan Stanley reiterated their buying rating and $166 price target.

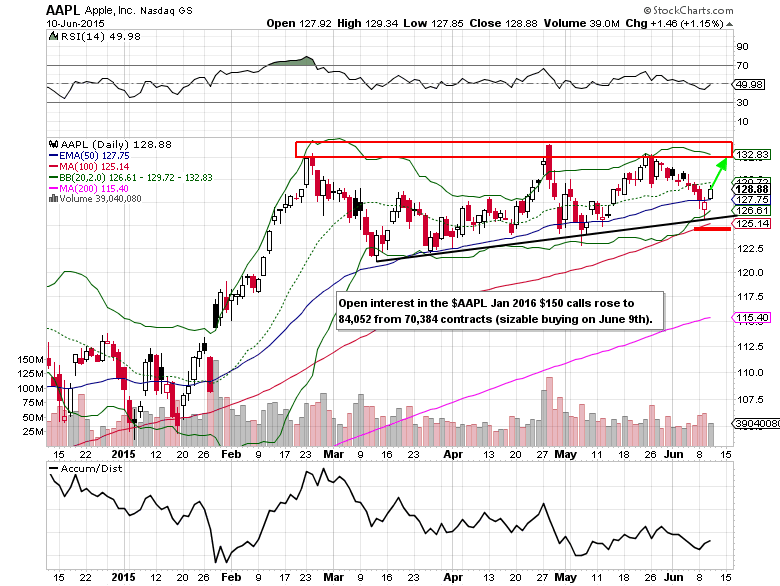

AAPL shares put in a higher low on June 10th, which was confirmed by the bounce at the uptrend line. The stock is now ready to make another run at the $132-$135 resistance level (would setup for $140+ on a breakout). Stop losses on long stock positions can be placed under the 100-day simple moving average for a little wiggle room in case of more volatility.

Apple Options Trade Ideas

Sell the July 10 weekly $124/$125 bull put spread for a $0.20 credit or better

(Sell the July 10 weekly $125 put and buy the July $124 put, all in one trade)

Stop loss reference- A move below $125 in the stock

Upside target- $0.05 debit or less

Maximum gain potential- 25%

Probability of hitting $125 by expiration- 28%

Or

Buy the July 17 $125 call for $5.60 or better

Stop loss- $2.50

1st upside target- $7.50

2nd upside target- $10.00