The S&P 500 mini-futures (ESU5) took a dive yesterday right out of the gate. They started declining when the European markets opened, and by 10 a.m. were down about 20 points. They clawed back to close at 2075.50, down 9.50 from the previous close, on light volume. It wasn’t quite a rout, but it could have been.

The apparent cause was the failure – yet again – to reach an agreement on the cursed Greek debt, as well as disappointing economic reports in the U.S. However as usual it is the Fed driving the market, with traders uneasy about the FOMC meeting starting today. The same uneasiness gave gold futures a nice little bump for the day.

Today

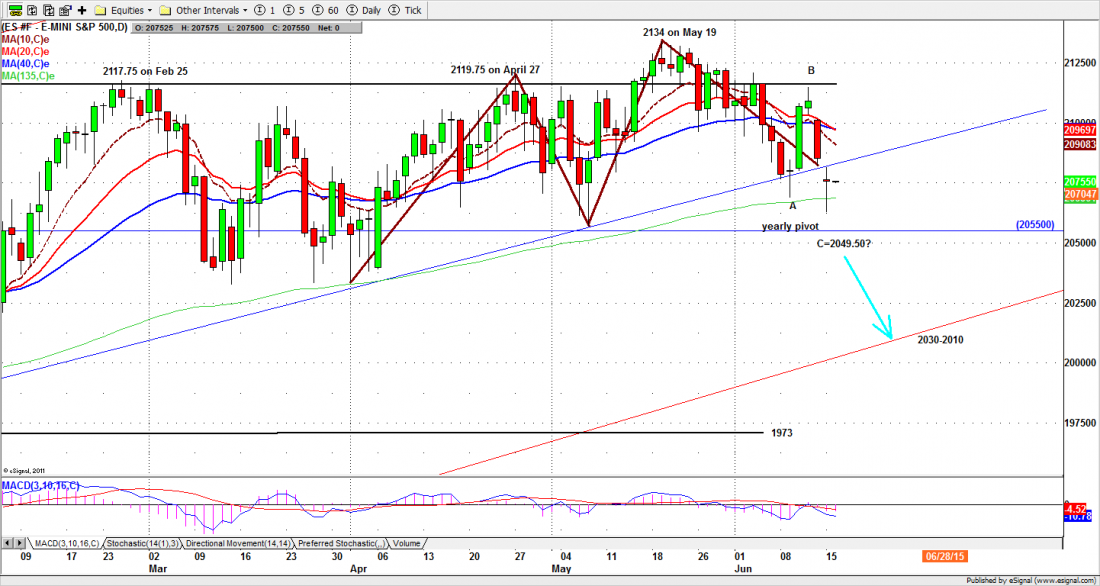

The futures broke the short-term uptrend line but managed to hold above the 135-day moving average line yesterday. The broken uptrend line becomes the current resistance (see chart) while the Bears will continue to challenge the 135-day moving average line. A break below 2060.50 will lead the ES to drop again toward 2050-55 to test the yearly pivot level — or lower if the downside momentum is strong.

We expect high volatility this week. The VIX option expires on Wednesday and If VIX falls below its most active Put strike price – around 14 – institutional traders will keep shorting future contracts as a hedge.

This could lead the price to move sharply down. But if the market reacts positively to FOMC news/rumors it could produce potentially powerful short-term rallies. The opposing forces will bounce the market around.

Major support levels for Tuesday: 2062-59.50, 2053-50.50, 2043-42;

major resistance levels: 2106-07, 2116-18.50, 2123.50-2121.75