The S&P 500 mini-futures (ESU5) dropped sharply after the market closed Monday and dropped to 2062.00 – the lowest price since the first week of May. And then the European markets opened, and the futures marched straight back up to recover all the losses from the start of the week … and then some.

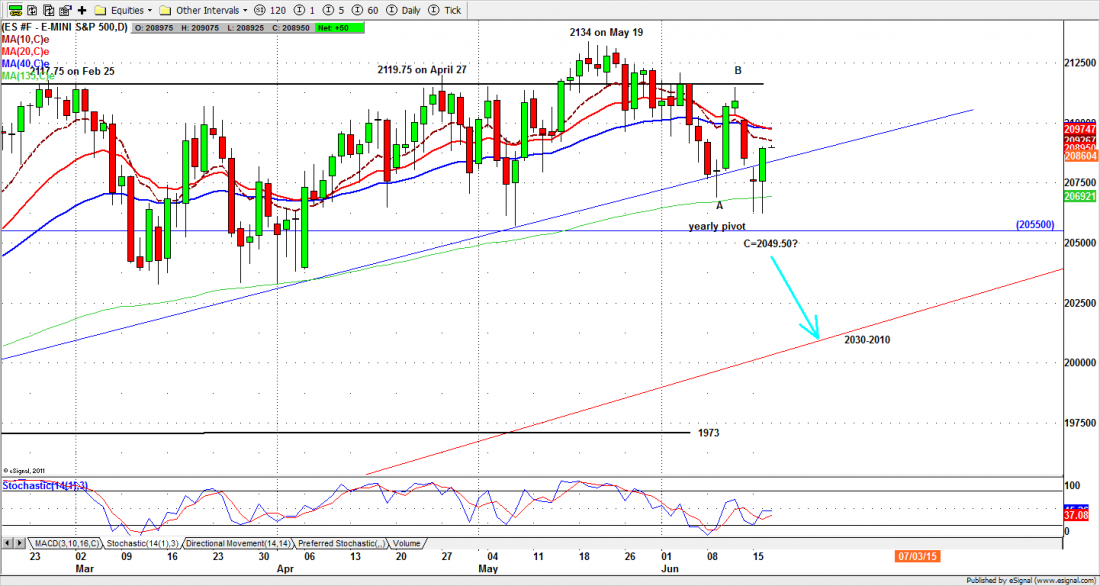

2062 seemed to be the foundation the futures were looking for. They not only regained the control of the broken short-term uptrend support line (see chart) they also held up well above the 135-day moving average line.

The ES closed the day session at 2089, just one point below the high of the day and 13.50 above the previous close, on decent volume. Definitely a bullish performance.

Today

Today (Wednesday) we will be looking to see if Tuesday’s rally was just another example of the volatility we were expecting this week. We will be watching for a move above the 2100 level to confirm that the recent decline ended with the doji formed on Monday, at least for the time being. In that case the ES may be heading back to the 2120-35 zone again.

The decisive element in determining if the rally is real will be the Fed. Today is FOMC announcement day and anything can happen. If the Fed delays or negates an immediate interest rate hike, it could lead the US market to rally again, and leave Monday’s remaining shorts scrambling to cover.

If the Fed does raise interest rates (which we think is unlikely) or merely talks up the possibility, the ES could go down to retest yesterday’s low again or drop further toward 2055. Even if the decline returns, we expect to see optimistic Bulls buying on the dips again. Hope springs eternal.

The major support levels for Wednesday: 2062-59.50, 2053-50.50, 2043-42

major resistance levels: 2106-07, 2116-18.50, 2123.50-2121.75