The S&P 500 mini-futures (ESU5) explored both sides of break-even yesterday. It went up higher than its prior day’s high after the FOMC minutes announced no interest rate change this time – as expected — but maybe a rate increase in September if the economic data is conducive. At the end, ES closed at 2089.25, one tick above the previous close.

Now the FOMC meeting is behind us, and everything should go back normal soon, which means more worries about the everlasting Greece crisis, and tomorrow’s quadruple witching expiration. Lots of intraday activity, but no clear-cut direction for the market.

Today

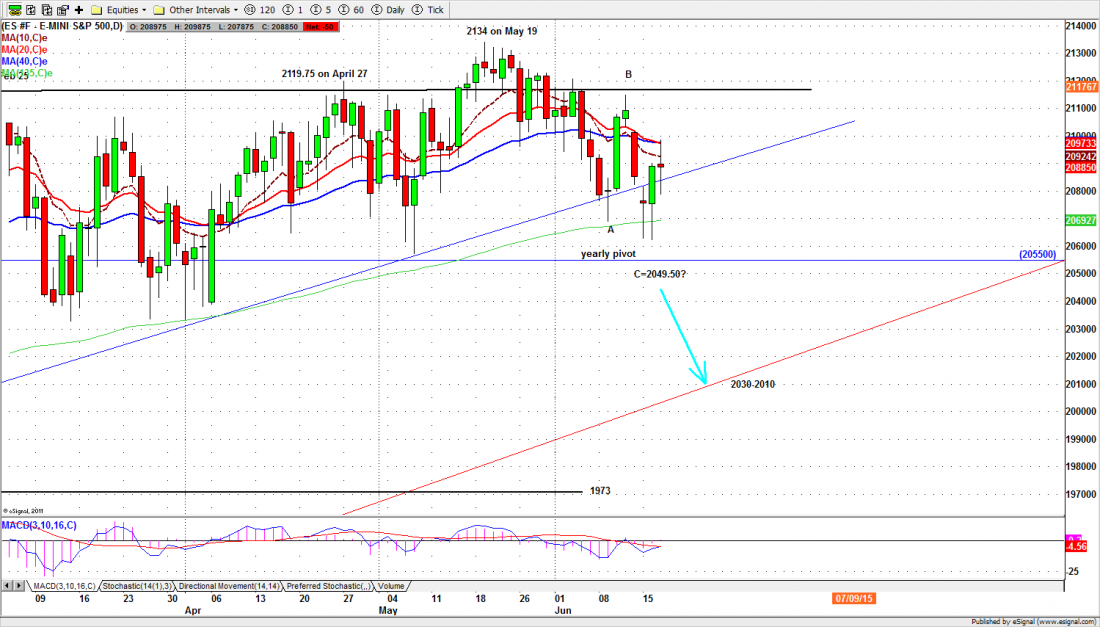

As long as ES stays under yesterday’s high 2098.75, the price should go back down to Monday’s low area 2065 for testing.

2075 will be a key line to watch first today. If today ES closes below it, the following day ES could go down to complete the A-B-C pattern.

The major support levels for Thursday: 2062-59.50, 2053-50.50, 2043-42

major resistance levels: 2106-07, 2116-18.50, 2123.50-2121.75